Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Market Review】--USD/CHF Forecast: Pulls Back Against the Swiss Franc as Rate

- 【XM Group】--Gold Analysis: Continued Upward Trend Possible

- 【XM Market Analysis】--AUD/USD Forecast: Rally Faces Resistance

- 【XM Group】--USD/CHF Forecast: Near Breakout Zone

- 【XM Market Analysis】--USD/BRL Forecast: US Dollar Testing Major Technical Barrie

market news

Gold continues to pay attention to the daily 5 moving average suppression, and it still fluctuates and pulls back before the holiday

Wonderful introduction:

Optimism is the line of egrets that are straight up to the blue sky, optimism is the ten thousand white sails beside the sunken boat, optimism is the lush grass that blows with the wind on the head of the parrot island, optimism is the falling red spots that turn into spring mud to protect the flowers.

Hello everyone, today XM Foreign Exchange will bring you "[XM Group]: Gold continues to pay attention to the daily 5 moving average suppression, and it still fluctuates and pulls back before the holiday." Hope it will be helpful to you! The original content is as follows:

Zheng's silver point: Gold continues to pay attention to the daily 5 moving average suppression, and it still fluctuates and pulls back before the holiday

Review yesterday's market trend and technical points:

First, in terms of gold: There was a wave of sell-off yesterday, breaking the daily 5 moving average, and 3317. I think that the c-wave correction is expected to be launched in the short term, but it is expected that the decline will not be too large. 3120 is a The low point of waves will not be lost; therefore, when the key support is successfully lost, the short-term operation will mainly change from last week's fluctuation and bullish to fluctuation and bearish;

Second, crude oil: yesterday, the support was given 60 up, the resistance was 64 down, and the rebound was at a minimum of 60.2, which basically conforms to the fluctuation within this range;

Interpretation of today's market analysis:

First, gold daily line level: the key to judging the turning point of a round of long and short It is the 5-day moving average, and the price continues to run above the 5th day, which is a small unilateral strong bullish operation, and the 10-momentum is the ultimate defense. Once it falls under the 10th day, it will xmaccount.completely weaken and bearish; yesterday closed at the negative K, and the closing has fallen by 5 days, but it temporarily supports 10 days; today's rebound confirms that the 3323 line on the 5th day is indeed somewhat suppressed, so today is waiting for which side of the 5th day and 10th day effective break, that is, 3323-3288, up and down It is normal to have a few US dollars errors; if you break through the station for 5 days again, you will test the trend resistance line of 3500-3438. Only by breaking through and standing on it can you be expected to test 3400, 3435, etc.; on the contrary, if the effective break is lost for 10 days, the c wave correction space will gradually expand, and the limit points to 3200-3190, which is also the lower rail derivative support point of the weekly upward channel; before the recent holiday, it is easy to have a wave.Retracement and fall, and return to a strong rise after the holiday; therefore, it is still inclined to oscillate and look at the pullback, and there are less than three days to operate and adjust;

Second, gold 4-hour level: This cycle has been mentioned, there are two key points, the middle track and 3317. Today, the European session rebounds upward to test the middle track, and it is currently effective in suppressing and is in a downward pullback; if the 22-point closing line still suppresses the middle track 3325, or below 3317, it will be highly likely to suppress downward tomorrow, because yesterday's break and fall, and today is a rebound confirmation. Once the suppression is effective, it will continue to weaken again;

Third, golden hourly line level: From the above figure, the current standard downward flag is in the shape of the flag, and the probability of finally breaking through the 3285 is still relatively high. As long as this pattern is effective, xmaccount.compared with the same decline, it can be at least point to 3250-3240; but there is a prerequisite, that is, it cannot break through the upper track of the yellow consolidation channel, so the downward flag will be invalid; therefore, tonight, rely on the upper track 3323 up and down to oscillate and look at the suppression, the lower track 3296-3300 pay attention to support, today the European market fluctuates up, and at this time, the US will pull back before the market, and there may be a second fluctuation and pull up after the market, and then see if the upper track can be suppressed in the second half of the night to suppress the downward trend;

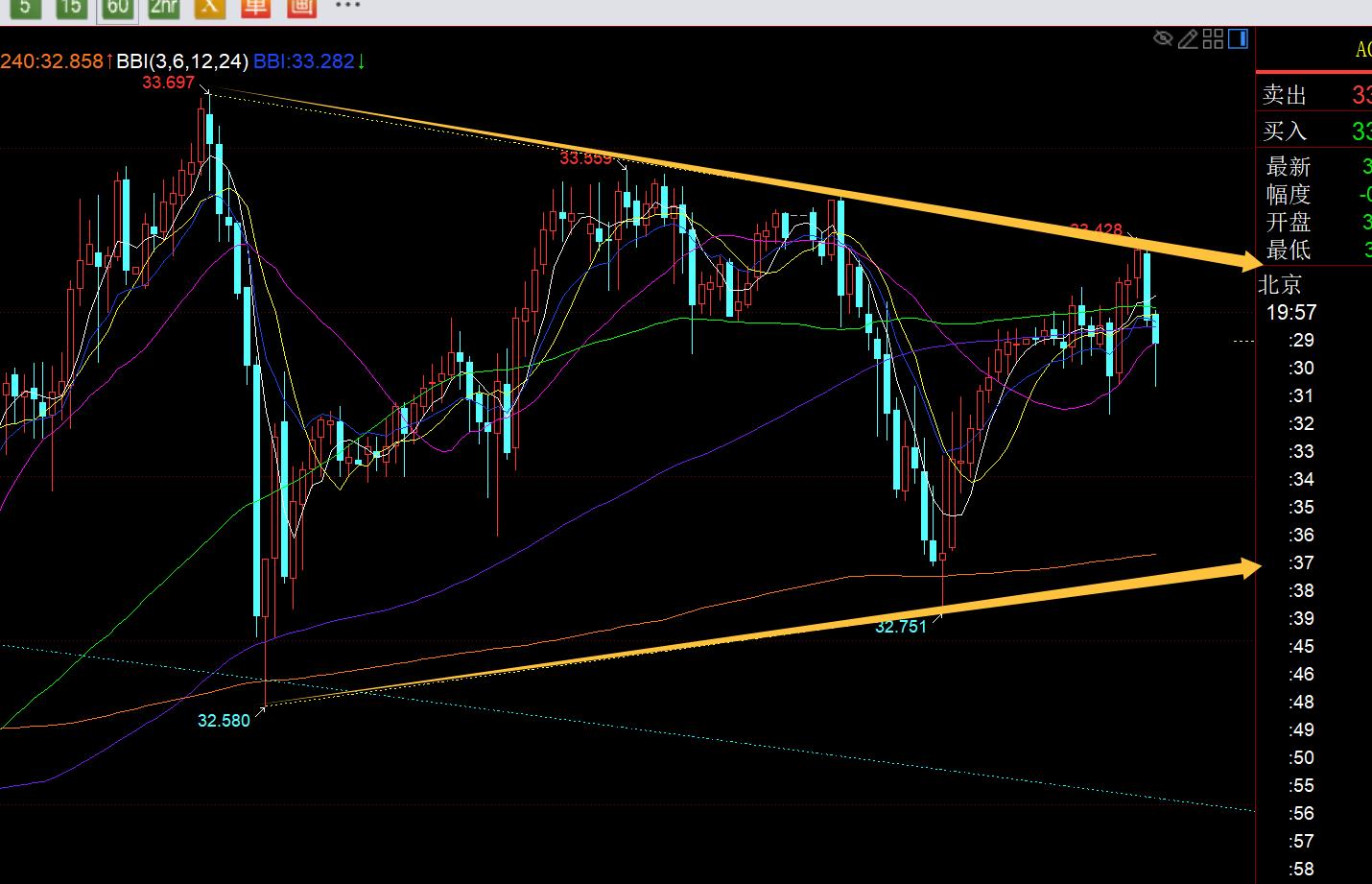

Silver: Silver has been in a period of oscillation recently. We will pay attention to the operation in the range of 33.5-32.7 tonight. It is currently in a certain triangle convergence. Once which side effectively breaks, the oscillation range may be expanded. It is estimated that it will be difficult to go to the unilateral side;

In terms of crude oil: crude oil and silver are basically the same, and they are constantly fluctuating. For the author's habit of trend market, he has no motivation or desire to participate in this kind of back and forth oscillation and repeated operation, so he basically watches the show; the large range is still running 60-64, so he can just try it at the right time; while the small range is also converging, between 60.4-61.7;

The above are several views of the author's technical analysis. As a reference, it is also a summary of the technical experience accumulated by the market watching and reviewing for more than 12 hours a day in the past twelve years. Technical points are disclosed every day, and they are interpreted in words and videos. Friends who want to learn can xmaccount.compare and reference based on actual trends; those who recognize ideas can refer to operations, lead defense well, and risk control first; those who do not agree should just be over; thank everyone for their support and attention;

[The article views are for reference only. Investment is risky. You should be cautious, rationally operate, strictly set losses, control positions, risk control first, and you will be responsible for your own profits and losses]

Contributor: Zheng's Dianyin

Presented on the market for more than 12 hours a day, insist on long-termFor ten years, detailed technical interpretations are made public on the entire network, serving to the end with sincerity, sincerity, perseverance and wholeheartedness! xmaccount.comments written on major financial websites! Proficient in the K-line rules, channel rules, time rules, moving average rules, segmentation rules, and top and bottom rules; student cooperation registration hotline - WeChat: zdf289984986

The above content is all about "[XM Group]: Gold continues to pay attention to the suppression of the daily 5 moving average, and it still fluctuates and falls back before the holiday". It is carefully xmaccount.compiled and edited by the XM Foreign Exchange editor. I hope it will be helpful to your trading! Thanks for the support!

Only the strong know how to fight; the weak are not qualified to fail, but are born to be conquered. Step up to learn the next article!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here