Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Market Review】--Gold Analysis: Expectations Still Positive

- 【XM Market Analysis】--Gold Analysis Today: Bulls Continue Attempts to Take Contr

- 【XM Market Review】--Weekly Forex Forecast – USD/JPY, USD/CAD, Gold, Coffee, Corn

- 【XM Group】--AUD/CHF Forecast: Selling Opportunities?

- 【XM Market Analysis】--USD/JPY Forecast: Continues to Rally

market analysis

【XM Decision Analysis】--EUR/USD Analysis: Bulls Await Further Stimulus

Risk Warning:

The purpose of information release is to warn investors of risks and does not constitute any investment advice. The relevant data and information are from third parties and are for reference only. Investors are requested to verify before use and assume all risks.

Hello everyone, today XM Forex will bring you "【XM Decision Analysis】--EUR/USD Analysis: Bulls Await Further Stimulus". I hope it will be helpful to you! The original content is as follows:

- EUR/USD bulls have recently attempted to maintain movement around and above the 1.0900 resistance to ensure an upward trend reversal.

- However, the upward rebound gains for the EUR/USD pair stopped around the 1.0947 resistance level, the highest for the pair in five months.

- The currency pair will start trading the new important week stable around the xmaccount.com1.0875 level, as Forex investors continue to monitor the reaction to the US Federal Reserve's announcement this week, the tone of the bank's policy statement, and the statements of its governor, Jerome Powell, amidst global political and trade shifts that threaten the future of economic recovery and the new US administration's desire for lower interest rates.

German Stimulus Supports Euro Gains

According to recent forex market trading, the euro rose against other major currencies in general, thanks to news of the German Green Party's approval of Merz's plans. German politicians had overcome a major hurdle by approving an unprecedented spending package proposed by new German Chancellor Friedrich Merz as part of a spending revolution. Overall, the Green Party's approval means a solid majority in the Bundestag to pass the constitutional amendments needed to boost borrowing for infrastructure and defence investment.

The German stimulus plan aims to allocate approximately 2% of GDP annually to infrastructure and defence spending over the next ten years. As a result, according to licensed trading platforms, the EUR/USD pair jumped back above the 1.09 resistance level, and German 10-year bond yields rose 5 basis points to 2.93.

For his part, German Chancellor Merz agreed to allocate approximately 10% of the €500 billion infrastructure spending package to environmental and climate investments, in an effort to win the support of his junior coalition partner. The euro's performance was clearly sensitive to concerns about stalled negotiations. Overall, the constitutional amendment legislation must be passed in the current Bundestag, where the CDU/CSU, the SPD, and the Greens hold the required two-thirds majority. Economists believe these plans will allow Germany to invest up to €1 trillion over the next decade, providing a much-needed boost to Europe's largest economy. They believe this will help lift all restrictions on economic activity. However, this type of spending takes time to plan and implement, meaning it won't be effective until 2026.

Trading Tips:

Be cautious, EUR/USD gains, unless they gain new positive momentum, may be subject to profit-taking selloffs, and be cautious of the important events of this week.

EUR/USD Forecasts for the xmaccount.coming Days

In this regard, according to Forex market experts, DNB Markets raised its short-term Euro forecasts, citing a change in investor sentiment and increased optimism about the prospects of the European economy. However, the improved forecast target remains below the current level, reflecting the continued "optimistic" stance towards the US dollar. This upgrade is necessary to reflect the sharp rise in the Euro's value, which saw its biggest rise since 2009. This rise is due to renewed confidence in European growth and the fading of US economic exceptionalism. DNB market experts added in a special note: "The news last week about a German 'whatever it takes' fiscal approach to infrastructure and defense has turned sentiment from pessimism to optimism." However, the bank remains optimistic about the US dollar in the long term, maintaining its 12-month EUR/USD forecast at 1.06, and warning that recent US economic concerns may be exaggerated.

The bank now expects EUR/USD to reach 1.04 in three months, up from a previous forecast of 1.00. EUR/USD may break the 1.12 level – prepare! Morgan Stanley raises its targets, indicating a major shift in currency dynamics.

For its part, DNB Markets dismissed recent US economic growth concerns as overblown and continues to expect the Federal Reserve to raise interest rates in December, contrary to market expectations of a rate cut. While acknowledging the global uncertainty, the bank predicted the US dollar would regain strength as markets adjust to improved US economic fundamentals.

However, the Danish National Bank also highlighted a potential long-term shift in global capital flows, as investors reassess risks associated with US trade policies and international relations. The Danish National Bank warned that "if we are on the cusp of a structural shift in global savings, we are opening the door to a significant repricing of the US dollar beyond what we have already experienced."

Despite this uncertainty, the bank emphasizes the strength of US economic fundamentals and believes that near-term market pricing is overreacting to geopolitical risks.

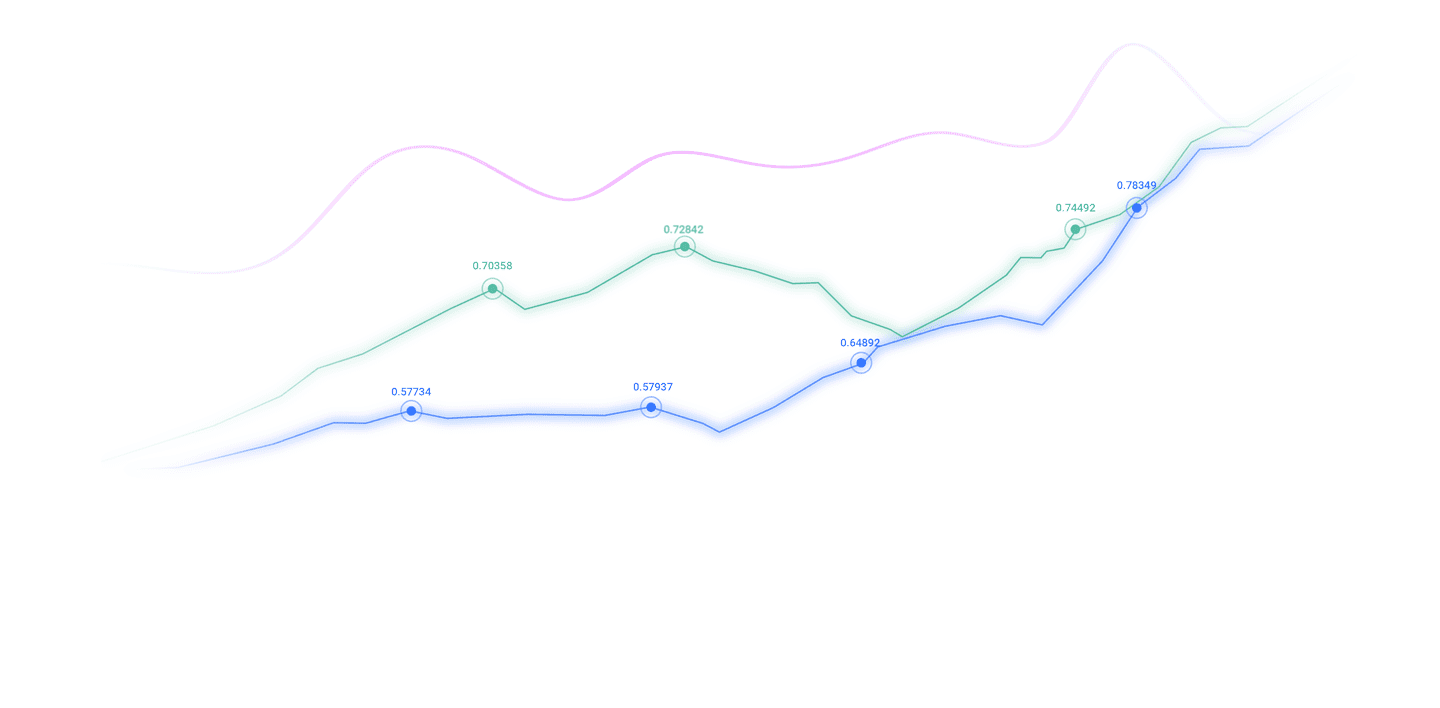

EUR/USD Technical Analysis Today:

Based on recent trading on the daily chart above, the EUR/USD pair is still on an upward trajectory. Moreover, bulls may need to move towards the psychological resistance of 1.1000 to confirm control of the trend. Simultaneously, this peak will move technical indicators towards strong overbought levels. At the same time, and over the same timeframe, a move towards the support level of 1.0760 will be important for bears in the event of a breakout of the current ascending channel.

We expect the EUR/USD pair to remain within narrow ranges around its current trajectory until financial markets and investors react to the US Federal Reserve's announcement, the Governor's remarks, and a package of important US economic releases, in addition to the trajectory of Trump's trade and political policies.

The above content is all about "【XM Decision Analysis】--EUR/USD Analysis: Bulls Await Further Stimulus", which is carefully xmaccount.compiled and edited by XM Forex editor. I hope it will be helpful for your trading! Thank you for your support!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here