Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Market Analysis】--Gold Forecast: Gold Sees a Little Momentum on Wednesday

- 【XM Forex】--EUR/USD Forecast: Plummets Below Major Support

- 【XM Decision Analysis】--Dax Forecast: Continues to Hang onto Support

- 【XM Forex】--BTC/USD Forecast: Bitcoin Struggles for Momentum Amid Fed Policy

- 【XM Decision Analysis】--EUR/CHF Forecast: Euro Rallies Against Swiss Franc on Fr

market news

US CPI data hit in August, and the ECB's September resolution may keep interest rates unchanged

Wonderful introduction:

Don't learn to be sad in the years of youth, what xmaccount.comes and goes cannot withstand the passing time. What I promise you may not be the end of the world. Do you remember that the ice blue that has not been asleep in the night is like the romance swallowed by purple jasmine, but the road is far away and people have not returned, where can the love be lost?

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Platform]: The US CPI data in August is xmaccount.coming, and the ECB's September resolution may maintain interest rates unchanged." Hope it will be helpful to you! The original content is as follows:

XM Forecast: The importance of economic data to be released this week is from high to low: US August CPI data, ECB resolution, and EIA energy monthly report. Next, we will interpret it one by one.

▲XM chart

This Thursday at 20:30, the U.S. Department of Labor will announce the US core CPI annual rate in August without seasonal adjustment, with the previous value of 3.1%, and the expected value remains unchanged. The United States did not adjust its annual CPI rate in August, and was announced at the same time. The previous value was 2.7%, the expected value was 2.9%, and the expected increase was 0.2 percentage points. Since nominal CPI data is affected by energy and fresh food prices, market participants value core CPI data more. If the latest annual value of the core CPI rate is consistent with expectations, it means that the United States' price list in August is stable and is not expected to change the Fed's expectation of restarting interest rate cuts in September. In August, U.S. crude oil prices fell 7.58%, reaching a low of $61.45 per barrel. The price of US crude oil is highly resonant with the US CPI data. Based on this, it is inferred that the annual rate of core CPI in August is likely to be lower than the previous value. Last Sunday, OPEC+ announced after a video conference that it would add about 137,000 barrels of oil production per day and would continue this pace of production increase until September next year. As OPEC increases production, U.S. crude oil prices may continue to fall, and the core CPI annual rate data in the United States may continue to decline. This will increase expectations of the Federal Reserve's continuous interest rate cuts, which is negative for the US dollar index.

▲XM chart

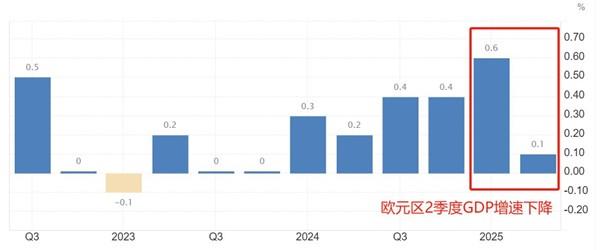

This Thursday at 20:15, the ECB will announce the results of the September interest rate resolution, and the mainstream expectation is that it will keep the three benchmark interest rates unchanged. According to economic data, the unemployment rate in the euro zone was 6.2% in July, down for two consecutive months. The core inflation rate in the euro zone remained at a low level of 2.3% for four consecutive months. The labor market and inflation rate both performed well, and the urgency of the ECB to cut interest rates is not high. However, in terms of economic totality, the annual GDP growth rate in the euro zone in the second quarter was 0.1%, far lower than The previous value is 0.6%, and the macro economy is still growing weak. In addition, the Federal Reserve may restart interest rate cuts on the September interest rate resolution. The ECB often follows the Federal Reserve's monetary policy operation, so the possibility of the ECB's September resolution announcing a rate cut still exists. EURUSD is at a relatively high level in the past three years, and the trend is relatively large. If the ECB announces keeping interest rates unchanged, the appreciation rate of the euro will expand. Even if the interest rate cut is unexpected, the euro may still maintain its current rise because the market pays more attention to the impact of the Fed's interest rate cut.

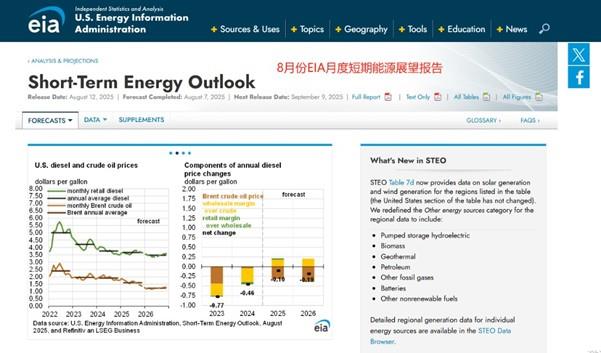

This Wednesday, at 0:00, EIA will release its monthly short-term energy outlook report, focusing on the forecasts of crude oil demand growth and price trends in the report. In the short-term energy outlook report in August, EIA expects Brent crude oil to fall sharply, with a low of $58. The reason for the pessimistic forecast is that oil inventories increase after OPEC+ member states decide to accelerate the pace of production increase. Last Sunday, OPEC+ The new food conference shows that the pace of production increase has further accelerated, with about 137,000 barrels of oil production per day. Based on this, EIA may be more pessimistic about the future oil price trend in its September report. The international topics that EIA is most concerned about in August are Trump tariffs, conflicts between Israel and Iran, and expansion of non-OPEC supply quotas. As August, factors affecting crude oil demand and prices have changed. India's purchase of Russian oil and the US debt is in sudden The conflict between Russia and Ukraine has become the focus of market attention. How EIA views these hot topics, and the judgment of the final impact of these events determines the impact of the report on U.S. crude oil.

XM risk warning, disclaimer, special statement: The market is risky, and investment should be cautious. The above content only represents the personal views of analysts and does not constitute any operational suggestions. Please do not regard this report as the only reference basis. In different periods, analysts' views may change, and the update will not be notified separately.

The above content is all about "[XM Foreign Exchange Platform]: The US CPI data in August is xmaccount.coming, and the ECB's September resolution may maintain interest rates unchanged". It is carefully xmaccount.compiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your transaction! Thank you for your support!

Spring, summer, autumn and winter, every season is a beautiful scenery,And they are all in my heart forever. Leave~~~

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here