Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Decision Analysis】--USD/CAD Forecast: Continues to Eye Massive Barrier

- 【XM Market Analysis】--USD/MXN Forex Signal: Rallies on New Years Eve Against Pes

- 【XM Decision Analysis】--EUR/USD Forex Signal: Double Bottom Pattern Forms

- 【XM Market Analysis】--AUD/USD Forex Signal: Bearish Price Channel Approaches 4-Y

- 【XM Forex】--USD/JPY Forecast: Near Key Support at 150

market news

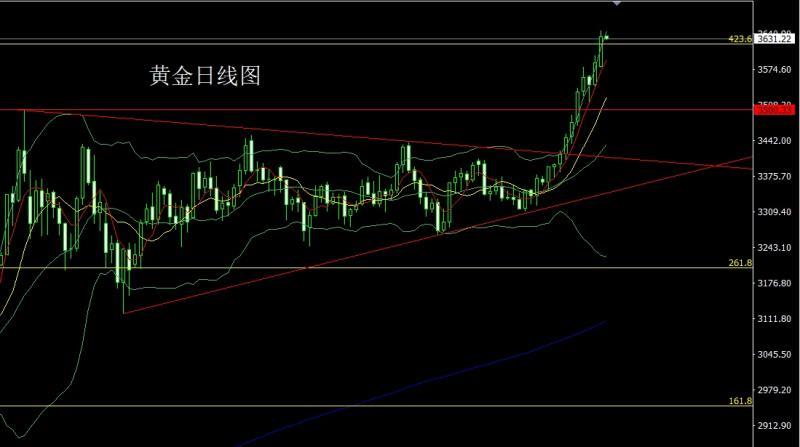

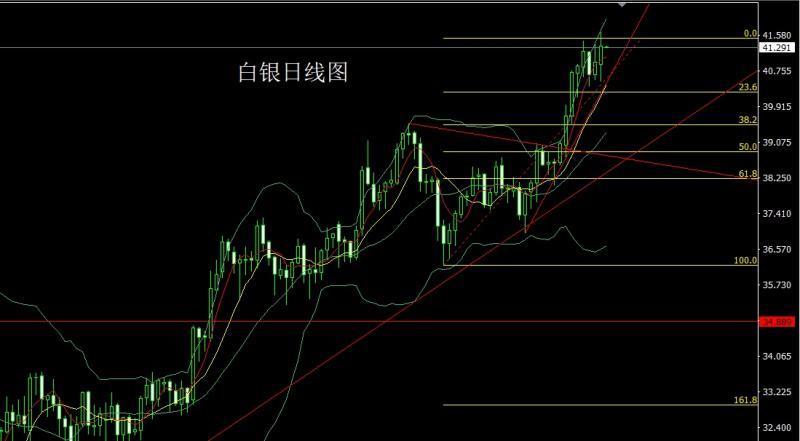

There is no pressure on the daily line, gold and silver are aimed at 3700

Wonderful introduction:

Without the depth of the blue sky, there can be the elegance of white clouds; without the magnificence of the sea, there can be the elegance of the stream; without the fragrance of the wilderness, there can be the emerald green of the grass. There is no seat for bystanders in life, we can always find our own position, our own light source, and our own voice.

Hello everyone, today XM Foreign Exchange will bring you "[XM Official Website]: Daily continuous positive momentum is not stressful, gold and silver are aimed at 3700". Hope it will be helpful to you! The original content is as follows:

Yesterday, the gold market continued to rise. After opening slightly lower in the early trading at 3580.2, the market fell and gave a position of 3578.1, the market fluctuated strongly and then rose rapidly. After breaking the integer mark at 3600, the market rose rapidly. During the US session, the daily line reached the highest position of 3646.7, and the market consolidated. After the daily line finally closed at 3635.2, the daily line closed with a large positive line with a longer upper shadow line. After this pattern ended, today's market still has a long demand, at the point, The long ones below and the long ones of 3325 and 3322 last week were 3368-3370 and the long ones of 3377 and 3385 were last week, and the stop loss followed by the stop loss followed by the 3450. The stop loss followed by the long ones of 3563 last Friday, and the stop loss followed by the 3559. Yesterday, the long ones around 3603 were held at 3600. Today's market is 3610, and the conservative 3608 was 3604. The target is 3625 and 3636 and 3645 and 3652. The break is 3663 and 3675-3680.

The silver market opened at 40.905 yesterday and then the market first rose. The market fell. The daily line was at the lowest point of 40.508 and then the market fluctuated strongly. The daily line reached the highest point of 41.664 and then the market consolidated. The daily line finally closed at 41.32 and then moved forward.The love closed with a medium-positive line with an upper and lower shadow line. After this pattern ended, it would take more to retrace today. At the point, the long position of 37.8 below and the long position of 38.8 last Friday, the stop loss followed at 39.5, and the long position of 40.85 today, the stop loss was 40.65, and the target was 412 and 41.5 and 41.7-41.8-42

Yesterday, the European and American markets opened low at 1.17123 and then the market fell first. The daily line was at the lowest point of 1.17027 and then the market fluctuated strongly. The daily line reached the highest point of 1.17654 and then the market consolidated. The daily line finally closed at 1.17626 and then the market closed with a large positive line with a lower shadow line slightly longer than the upper shadow line. After this pattern ended, the daily line effectively broke the pressure, and today's market rebound continued to be long. At the point, the stop loss was more than 1.17400 today, and the target was 1.017650 and then 1.17800 and 1.18000.

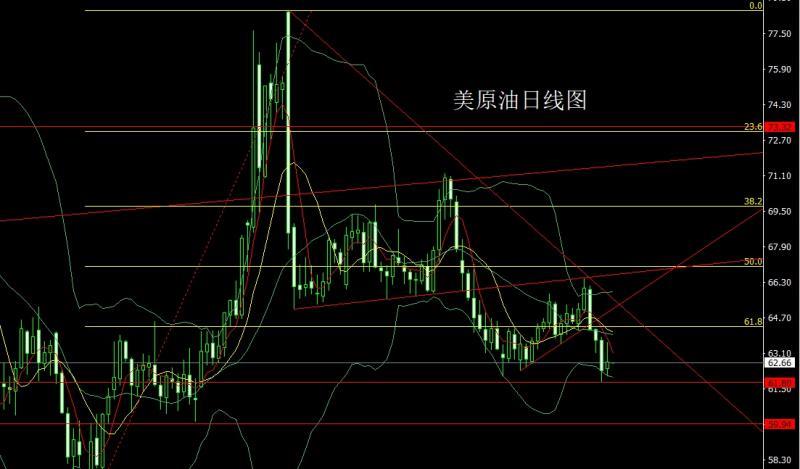

Yesterday, the US crude oil market opened at 62.4 in the morning, and the market fell first. The daily line was at the lowest point of 62.11 and then the market fluctuated and rose strongly. The daily line reached the highest point of 63.58 and then the market fluctuated and fell at the end of the trading session. After the daily line finally closed at 62.7, the daily line ended with a very long inverted hammer head pattern. After this pattern ended, today's short stop loss of 63.7 at 63.2, the target was 62.5 and then 62.1 and 61.8-61.5.

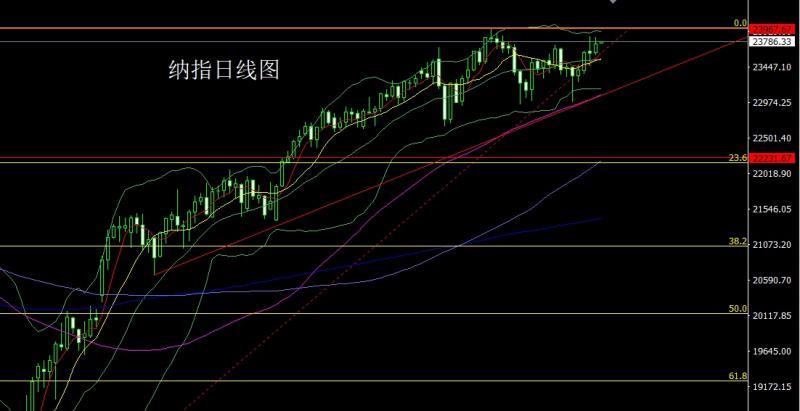

Nasdaq market opened at 23645.49 yesterday and the market fell first. The daily line was at the lowest point of 23614.07 and then the market fluctuated strongly. The daily line reached the highest point of 23853.13 and then the market consolidated. The daily line finally closed at 23758.85, and then the market closed with a medium-positive line with a long upper shadow line. After this pattern ended, the stop loss of more than 23650 today was 23590, and the target was 23750 and 23800 and 23860. The target was 23920 and 23970.

The fundamentals, yesterday's fundamentals. The US Senate group will vote on the nomination of the Federal Reserve Board of Milan on Wednesday. After passing, the whole vote will be held. Saudi Arabia lowers crude oil prices sold to Asian markets. OPEC+ received updated oil xmaccount.compensation plans submitted by member states. So yesterday, gold prices rose and the crude oil market fell. Today's fundamentals mainly focus on the initial value of the US non-agricultural employment benchmark changes in 2025 (10,000 people).

Operation, gold: 332 below5 and 3322 long and 3370 long and 3377 and 3385 long and 3385 long and 3450 long and 3450 long. Last Friday, 3563 long and 3559 held at 3559. Yesterday, 3603 chased long and 3600 held at 3600 held at 3600. Today's market is 3610 more conservative 3608 long stop loss 3604, targets are 3625 and 3636 and 3645 and 3652, breaking the position is 3663 and 3663 and 366 75-3680.

Silver: The long at 37.8 below and the long at 38.8 last Friday, the stop loss followed up at 39.5, and the stop loss was 40.65, and the target was 412 and 41.5 and 41.7-41.8-42

Europe and the United States: 1.17400 and the stop loss was 1.17200, and the target was 1.017650 and then 1.17800 and 1.18000.

U.S. crude oil: 63.7 short stop loss today, target 62.5 and then 62.1 and 61.8-61.5.

Nasdaq: 23650 stop loss today, target 23590, target 23750 and 23800 and 23860. Break the position and see 23920 and 23970.

Yesterday, 3603 chased long

The above content is all about "[XM official website]: Daily line continuous positive without pressure, gold and silver sword pointing at 3700". It was carefully xmaccount.compiled and edited by the editor of XM Forex. I hope it will be helpful to your trading! Thanks for the support!

Share, just as simple as a gust of wind can bring refreshment, just as pure as a flower can bring fragrance. The dusty heart gradually opened, and I learned to share, sharing is actually so simple.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here