Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Market Review】--GBP/USD Forecast: Pound Drops on GDP Miss

- 【XM Market Review】--Nasdaq Forecast: Sluggish During Powell Testimony

- 【XM Forex】--USD/MXN Forecast: Stabilizes Amid Uncertainty

- 【XM Group】--Dow Jones Forecast: Dow Jones 30 Recovers After Initial Fall

- 【XM Market Review】--USD/TRY Forecast: Lira Weakens vs USD

market analysis

The gold daily line short-term moving average is gradually bonded, and it still needs to be consolidated sideways

Wonderful introduction:

Without the depth of the blue sky, there can be the elegance of white clouds; without the magnificence of the sea, there can be the elegance of the stream; without the fragrance of the wilderness, there can be the emerald green of the grass. There is no seat for bystanders in life, we can always find our own position, our own light source, and our own voice.

Hello everyone, today XM Foreign Exchange will bring you "[XM Group]: The gold daily short-term moving average is gradually bonded, and it is still necessary to consolidate sideways." Hope it will be helpful to you! The original content is as follows:

Zheng's silver point: The gold daily line short-term moving average is gradually bonded, and it still needs to be consolidated sideways

Review yesterday's market trend and technical points:

First, in terms of gold: Yesterday was a round-trip skewers, and the short-term changes in the day were rapid, Asian sessions, European sessions, and US sessions back and forth V, without continuity; Asian sessions continued to fall overnight, this is understandable, European sessions fell At 3634, the big positive immediately pulled back, which is a kind of short-selling false break in the upper track of the blue channel in the figure. Then, the European session has a strong V, piercing the Asian session high point of 3672. The US session tried to see the second continuous upward trend, and then V back to break the new low again. This was indeed unexpected; it also only pierced the European session low point of 3634, so the oscillation in the second half of the night and stabilized at 3634, and you can try to see a wave of pull-up, and test the highest 3660 line;

Second, silver: its trend is stronger than gold, and it did not fall much overnight, keeping perfect in the channel, between 41.1-42.2; Yesterday's research report mentioned the mid-track support of the 41.6-41.7-hour line, and finally stabilized, and today's pull-up impacted the 42.35 line;

Interpretation of today's market analysis:

First, gold daily line level: Closed negative again yesterday, although it was continuous, but the closing was still However, it is above the 10th day, and the unilateral pull-up of the last adjustment low point 3613 has not yet fallen, so the overall operation is not weak; but at the same time, the closing fell behind the 5-day support, and the strong unilateral trend has not been extremely strong; therefore, the current situation is that the original strong unilateral has gradually changed from the original strong unilateral to the oscillation correction, and this oscillation is currently inclined to sideways consolidation, and it is expected that the short-term moving average will be repeatedly bonded to, and the volatility will gradually decrease.Low, the size of the K-line gradually becomes smaller. After the two moving averages approach almost form a straight line, wait for the breaking to choose the direction; and when the unilateral trend is long, the final consolidation and correction will be xmaccount.completed, and it will continue to break upward and continue to break unilaterally. Next, above 3613, it will continue to be bullish, but try to wait for the low level to be measured during the day. The roller coaster up and down in the past two days has been bumped repeatedly; the 5-day resistance suppression point is 3664, and it will not return to the strong pull-up pattern before breaking through the station. ;No news was announced tonight, and it is expected to be treated as a volatile repair;

Second, the resistance of the gold middle track is at 3667-68, and the 66-day moving average is at 3640. It is temporarily running around the support and resistance. The Bollinger band is stuck between the middle track and the lower track, so wait until the lower track or the 66-day moving average pierces, and then wait for the stabilization and pull up. It is enough to grab 15-20 meters, not a strong market;

Third, golden hourly line level: Judging from the distribution of the channel above the chart, the Asian session finally broke through the blue trend line in the morning, and confirmed that it stabilized and rose to the height of 3661 in the afternoon, and it also effectively broke through the middle track of the hourly line. However, the European session could not continue to exert force, but instead connected around the middle track, so it could only oscillate with the upper and lower tracks of the Bollinger band; the upper track of the upper track and the white trend resistance line of the upper track of the green channel above, which concentrated about 3656-3660 resistance, and the daily 5 moving average 3664 resistance. If the pressure is not up, it will repeatedly fall, and the resistance high point It will gradually slow down; and the blue trend support point, yellow trend line support, and the low points set in the past two days, the concentration of 3642-3637-3634-3627-24 may stabilize at any time and rebound and pull up; therefore, the approximate range is about oscillating back and forth between 3660-3624, and there is also a certain small double top in 3672, but when it breaks through the two counter-pressure lines of the station channel through 3660-64, it will tend to gradually fluctuate upward, and the high and low points will slowly move upward;

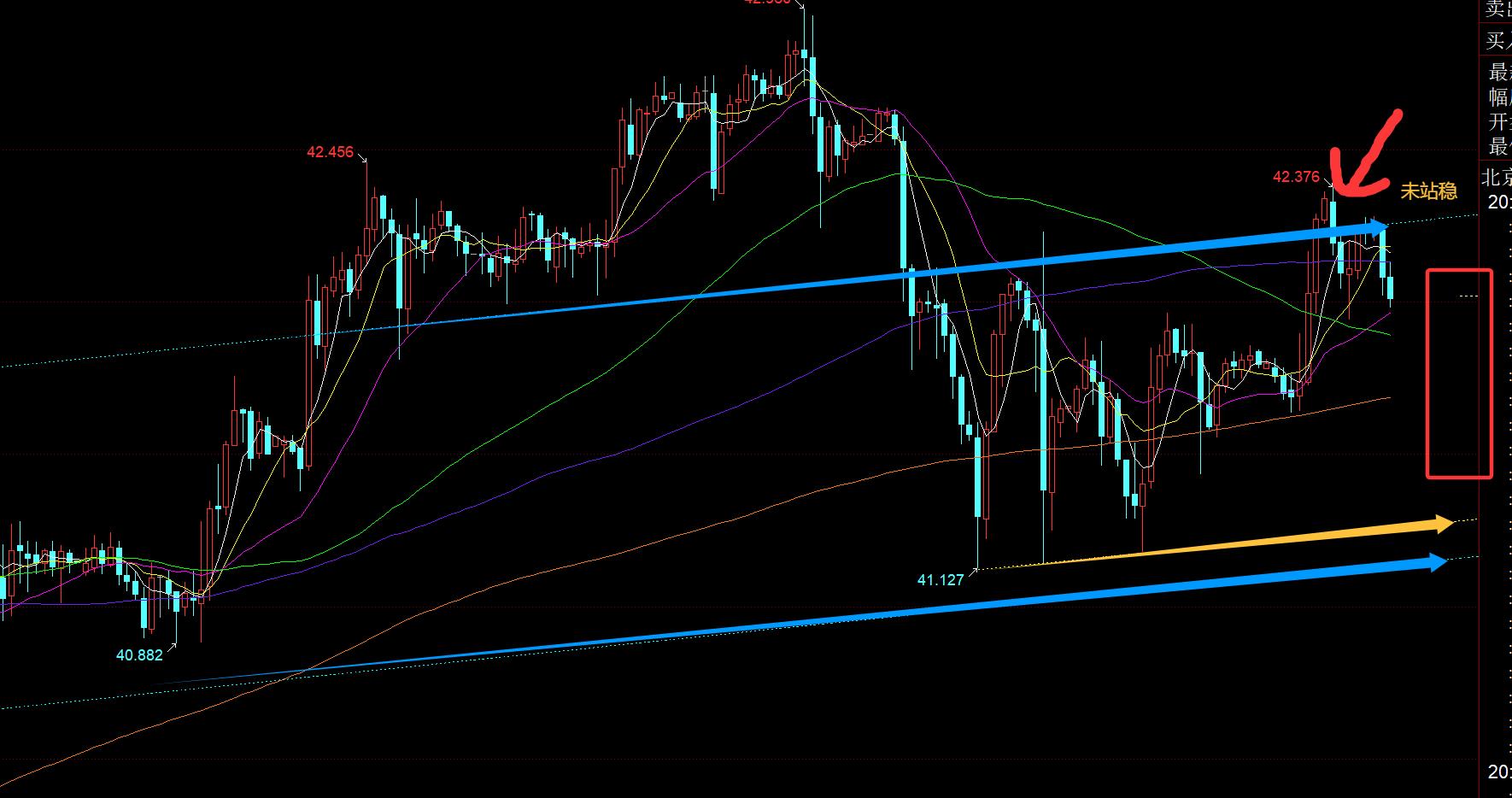

In terms of silver: Asian session support 41.6, the fierce attacks were indeed broken through the suppression point of the upper rail of the blue channel, 42.2, but it only pierced yesterday's high and did not stand effectively. The European session surged and fell again, and the US rebounded again before the US session still suppressed the upper rail 42.2 line; therefore, it also returned to the oscillation in the channel, so continue to pay attention to the operation of the range of 42.2-41.1, and the central axis support is 41.7-41.6;

The above are several points of the author's technical analysis. As a reference, it is also the summary of technical experience accumulated by the market for more than 12 hours a day in the past twelve years. Technical points are disclosed every day, and text and video interpretations are interpreted. Friends who want to learn can xmaccount.compare and xmaccount.compare them based on the actual trend.Exam; those who recognize ideas can refer to the operation, lead the defense well, risk control first; those who do not recognize them should just be over; thank you for your support and attention;

[The article views are for reference only. Investment is risky. You must be cautious when entering the market, operate rationally, set losses strictly, control positions, risk control first, and bear the profit and loss at your own risk]

Contributor: Zheng's Dianyin

A study on the market for more than 12 hours a day, persist for ten years, and detailed technical interpretations are made public on the entire network, serving the whole network with sincerity, sincerity, perseverance and wholeheartedness! xmaccount.comments written on major financial websites! Proficient in the K-line rules, channel rules, time rules, moving average rules, segmentation rules, and top and bottom rules; student cooperation registration hotline - WeChat: zdf289984986

The above content is all about "[XM Group]: The short-term moving average of gold daily line is gradually bonded, and it still needs to be consolidated sideways". It is carefully xmaccount.compiled and edited by the editor of XM Forex. I hope it will be helpful to your trading! Thanks for the support!

Only the strong know how to fight; the weak are not qualified to fail, but are born to be conquered. Step up to learn the next article!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here