Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- A collection of positive and negative news that affects the foreign exchange mar

- Multi-factor hedging, the US dollar against the Canadian dollar is tangled with

- 8.18 Gold oversold divergence plus boots landed, and today it will be a low-smal

- Copper prices fluctuate at high levels waiting for macro guidance, Chile's expec

- 8.22 Gold fluctuates in a narrow range, can the weekly end be in circulation

market news

Risk aversion rekindles yang and yin, gold and silver reach new highs

Wonderful introduction:

Only by setting off, can you reach your ideals and destinations, only by hard work can you achieve brilliant success, and only by sowing can you reap the rewards. Only by pursuing can you taste upright people.

Hello everyone, today XM Forex will bring you "[XM Foreign Exchange Market Analysis]: Risk aversion rekindles the yang and yin, and gold and silver reach new highs." Hope this helps you! The original content is as follows:

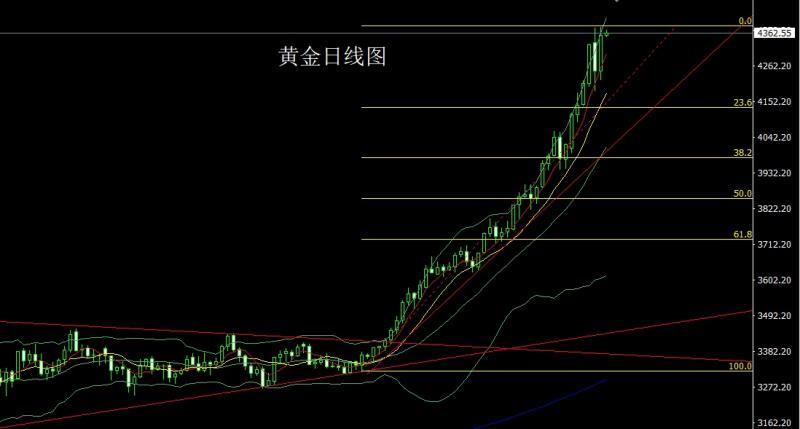

Yesterday, the gold market opened at 4246.8 in early trading and then the market fell first. The daily minimum reached 4218, and then the market started to rise. After breaking the 4305 pressure, the US market session The market rose rapidly, and the daily line reached a record high of 4382.2. After finishing, the daily line finally closed at 4355.6. The daily line closed with a big positive line with a lower shadow line slightly longer than the upper shadow line. And like this After the end of the pattern, the adjustment of the daily Yang Bao Yin ended. In terms of points, the longs of 3325 and 3322 below and the longs of 3368-3370 last week and the longs of 3377 and 3385 and the longs of 3563 were followed by the stop loss. Holding at 3750, today it will first fall back to 4310 and be conservative and stop loss at 4307 and 4302. The target is 4350 and 4382. If the position is broken, the pressure will be 4393 and 4400, 4410 and 4425.

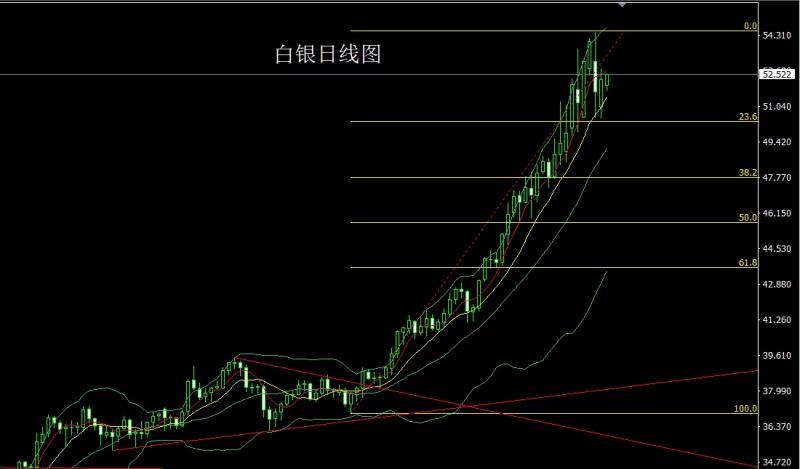

The silver market opened low yesterday at 51 and then the market fell first. The daily line reached the lowest position of 50.468 and then the market rose strongly. The daily line reached the highest position of 52.761 and then the market consolidated. The daily line finally closed at 52.282. , the daily line closes with a big positive line with the same length as the upper and lower shadow lines. After the end of this form, the long position below 37.8, the long position of 38.8, and the long position of 44.6 will be reduced and the stop loss will be held at 47. Today, the stop loss will be 51.75, and the target is 52.6 and 53-53.5.

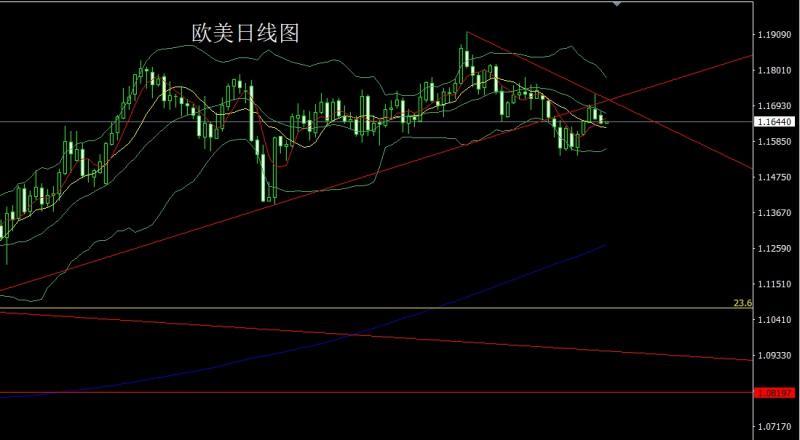

European and American markets opened at 1.16632 yesterday, and then the market first fell back to 1.16508 and then rose strongly. The highest daily line touched 1.16753, and then the market fluctuated strongly and fell back. The lowest daily line reached 1.16370, and then the market consolidated. The daily line finally closed at 1.16370. After the position of 1.16406, the daily line closes with a barline line with a long upper shadow line. After the end of this form, today's market has continued downward pressure. At the point, today's 1.16650 short stop loss is 1.16850, and the target is 1.16350, 1.16100 and 1.15850.

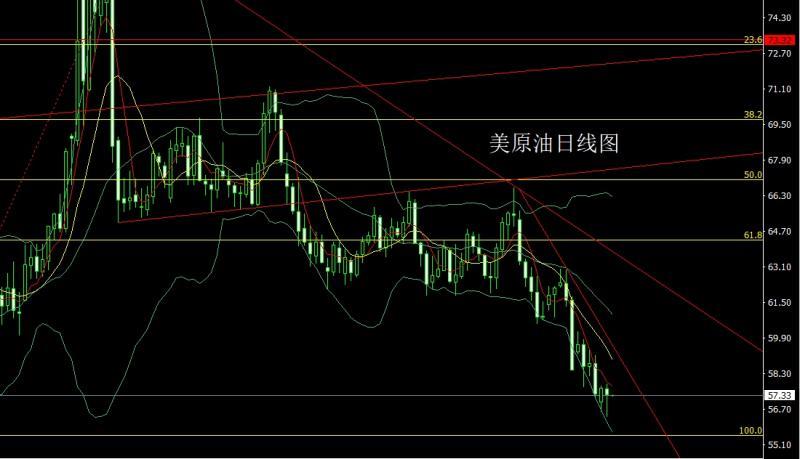

The U.S. crude oil market opened at 57.63 yesterday and then the market rose slightly to reach 57.85. Then the market fluctuated strongly and fell back. The daily line reached the lowest position of 56.35 and then the market rose strongly in late trading. The daily line finally closed at 57. After the position of 33, the daily line closed in the form of a hammer with a very long lower shadow. After the end of this form, today's 56.7 is more than 56.2, with a target of 57.3 and 57.85, and a break of 58 and 58.35-58.5.

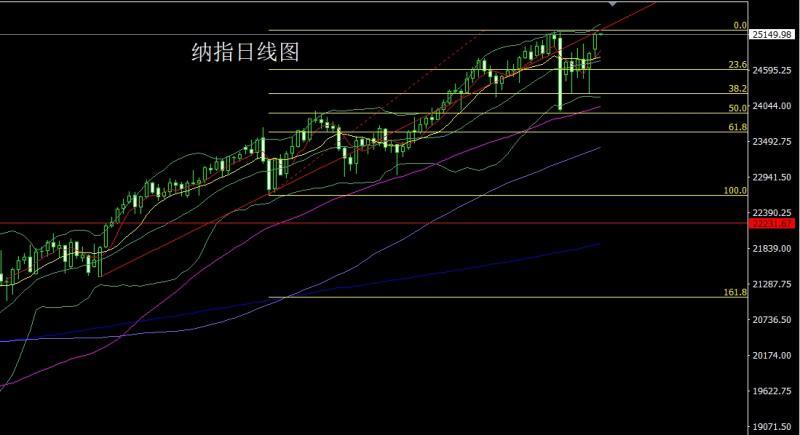

The Nasdaq opened higher yesterday at 24923.2, then the market first fell back to 24785.73, and then the market rose strongly. The daily line reached the highest position of 25188.75, and then the market consolidated. After the daily line finally closed at 25149.69, the daily line closed at 25149.69. The Zhongyang line with a long lower shadow line closes, and after the end of this form, today's stop loss is 24890 over 24950, and the target is 25100, 25200 and 25300-25350.

Fundamentals, yesterday's fundamentals National Bureau of Statistics: China's GDP increased by 5.2% year-on-year in the first three quarters. In a remarkable performance, White House official Hassett said the government shutdown may end this week; if it does not end, the White House will consider taking tougher measures. The President of the United States and the Prime Minister of Australia signed an agreement on rare earths and critical minerals at the White House on Monday. Albanese called it a "shovel-ready partnership" worth $8.5 billion. As part of the deal, the two sides agreed to cut approval processes for mining, processing facilities and related operations to increase production of rare earths and critical minerals. "In about a year, we will have so many critical minerals and rare earths that you won't know what to do with them," the US president said. The White House said in a statement that the U.S. and Australian governments plan to jointly invest more than $3 billion in critical mineral projects in the next six months. The prices of recoverable resources in these projectsThe value is estimated at US$53 billion. The White House pointed out that the Pentagon will invest in the construction of a gallium processing plant with an annual production capacity of 100 tons in Western Australia. Today's fundamentals focus on the Federal Reserve's payment innovation meeting to discuss stablecoins, artificial intelligence and tokenization and the Asia-Pacific Economic Cooperation (APEC) Finance Ministers' meeting, which will be held until October 22.

In terms of operation, gold: the longs of 3325 and 3322 below, the longs of 3368-3370 last week, the longs of 3377 and 3385, and the longs of 3563. After reducing positions, the stop loss is followed up at 37 50 holding, today it will fall back to 4310 and more, conservatively 4307 and more, stop loss 4302, the target is 4350 and 4382, if the position is broken, look at 4393 and 4400, 4410 and 4425 pressure.

Silver: The bottom is 37.8 long, 38.8 long and 44.6 long. After reducing the position, the stop loss is followed up and held at 47. Today, the 52 long stop loss is 51.75. The target is 52.6 and 53-53.5.

< p>Europe and the United States: 1.16650 today, short stop loss 1.16850, target 1.16350, 1.16100 and 1.15850.US crude oil: today 56.7 long stop loss 56.2, target Look at 57.3 and 57.85, and look at 58 and 58.35-58.5 for breakouts.

Nasdaq: Stop loss at 24890 for today's 24950, target 25100, 25200 and 25300-253 50.

The above content is all about "[XM Foreign Exchange Market Analysis]: Risk aversion rekindles yang and yin, gold and silver reach new highs". It is carefully xmaccount.compiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your trading! Thanks for the support!

Every successful person has a beginning. Only by having the courage to start can you find the way to success. Read the next article now!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here