Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

market news

After gold retreated, it rose according to the rhythm, while Europe and the United States fluctuated and fell.

Wonderful introduction:

Youth is a nectar made with blood drops of will and sweat of hard work - it will last forever; youth is a rainbow woven with unfading hope and immortal yearning - it is brilliant and brilliant; youth is a copper wall built with eternal persistence and tenacity - it is impregnable.

Hello everyone, today XM Foreign Exchange will bring you "[XM Official Website]: Gold rose according to the rhythm after the retracement, and Europe and the United States fluctuated and fell." Hope this helps you! The original content is as follows:

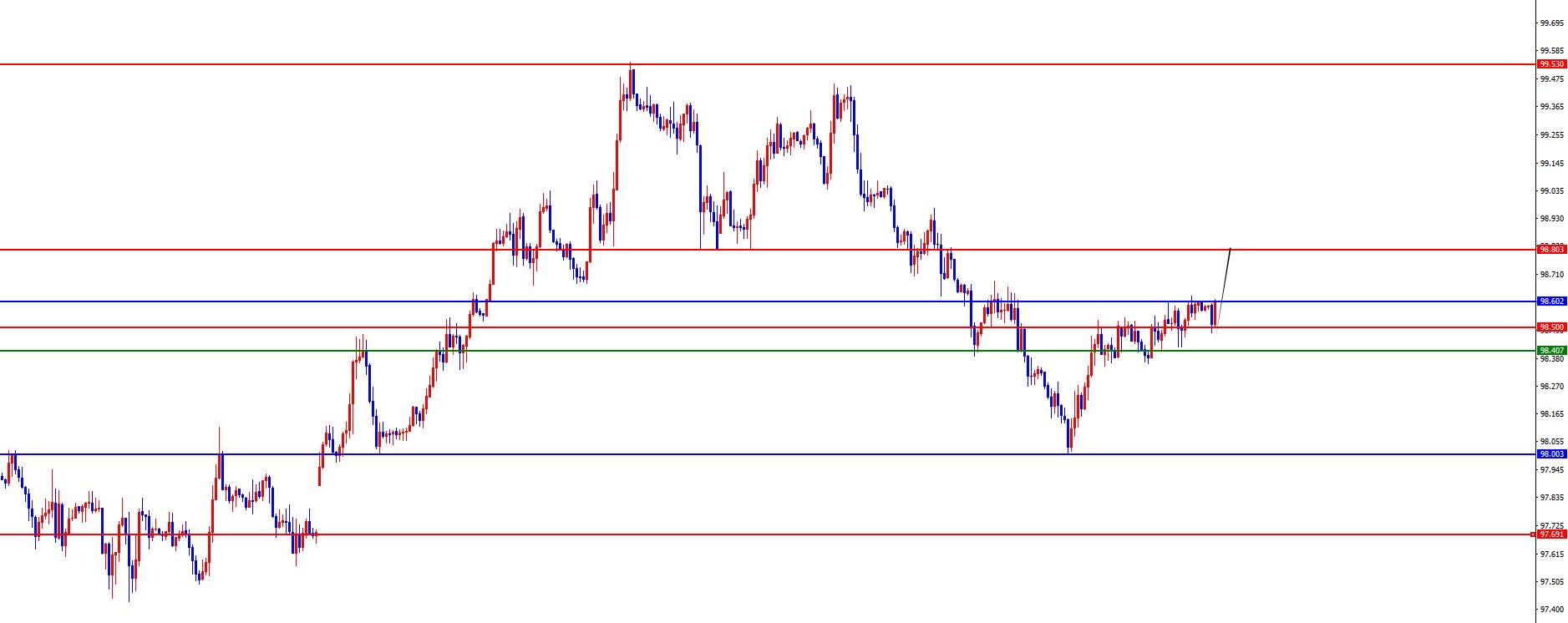

U.S. Dollar Index

In terms of the performance of the U.S. Dollar Index, the U.S. Dollar Index showed an upward trend on Monday. The U.S. dollar index price climbed to a maximum of 98.623 that day, dropped to a minimum of 98.36, and finally closed at 98.598. Looking back at the overall market performance on Monday, prices fluctuated in the short term during early trading, then rose again before the European market relying on four-hour support, and finally ended in a positive state that day.

From a multi-cycle analysis, the weekly price stabilized last week after continuing to fluctuate in the early stage. Last week, the price stepped back on the weekly support position and fell. The current weekly support is in the 98 area. Follow-up attention will be paid to further mid-term bulls (need to pay attention to the gap position). From the daily level, as time goes by, the current daily resistance is in the 98.60 area. This position is the key to the band trend. The price has been consolidating up and down at this position recently. Short-term operations need to be xmaccount.combined with small cycles. From a four-hour perspective, during the recent fluctuations, we found that the price relied on the four-hour key position. As yesterday's price broke through the four-hour resistance, this position became a key support. The position is temporarily focused on the 98.40-50 range. We will rely on this area to see further growth in the future. In one hour, the current price is also bullish, so we will focus on the bullish operation for the time being, and the upper side will temporarily focus on the 98.80 area resistance.

The US index is in the 98.40-50 range, with a defense of 5 US dollars and a target of 98.80 (the price will only fill the gap if it breaks the four-hour support again, otherwise it will be treated as more short-term)

Gold

In terms of gold, the price of gold generally showed an increase on Monday. The price rose to a maximum of 4381.24 on that day, fell to a minimum of 4218.93, and closed at 4356.25. During the early trading on Monday, the price was first under pressure at the four-hour resistance position, and at the same time, the intraday fluctuation showed a volatile rise. The price broke through the four-hour resistance before the U.S. market. Overall, it still followed the rhythm of the pullback and then the rise that we emphasized to everyone, and the daily line ended in a positive trend.

From a multi-cycle analysis, first observe the monthly rhythm. From a long-term perspective, the 3150 position is the watershed of the long-term trend. The price can be treated as long as it is above this position. From the perspective of the weekly level, the current dividing line between long and short on the weekly line is at 3670, and the price can be treated as long as the midline is above this position. From the daily level, we need to pay attention to the support of the 4105 area for the time being, and the bands above this position should be treated more. From a four-hour perspective, four hours is the focus we have been emphasizing. Yesterday, the price broke through the four-hour resistance again, and this position became a short-term support area. Focus on the 4300 area support position. The short-term position above this position is still bullish. At the same time, if we look at yesterday's strong closing in one hour and there is no direct surge during today's early trading, we will temporarily focus on the support of the 3435 area, the low point of yesterday's early morning retracement. Whether this position can be directly pulled up will determine whether it is a very strong rise (the European market needs to break high again). If it breaks down, then focus on the four-hour support to see the continuation.

The gold 4300 area is more, defense is 4280, and the target is 4370-4420-4480 (the radicals will be more tentative in the 4335 area first, and the European market will break high before it is stable)

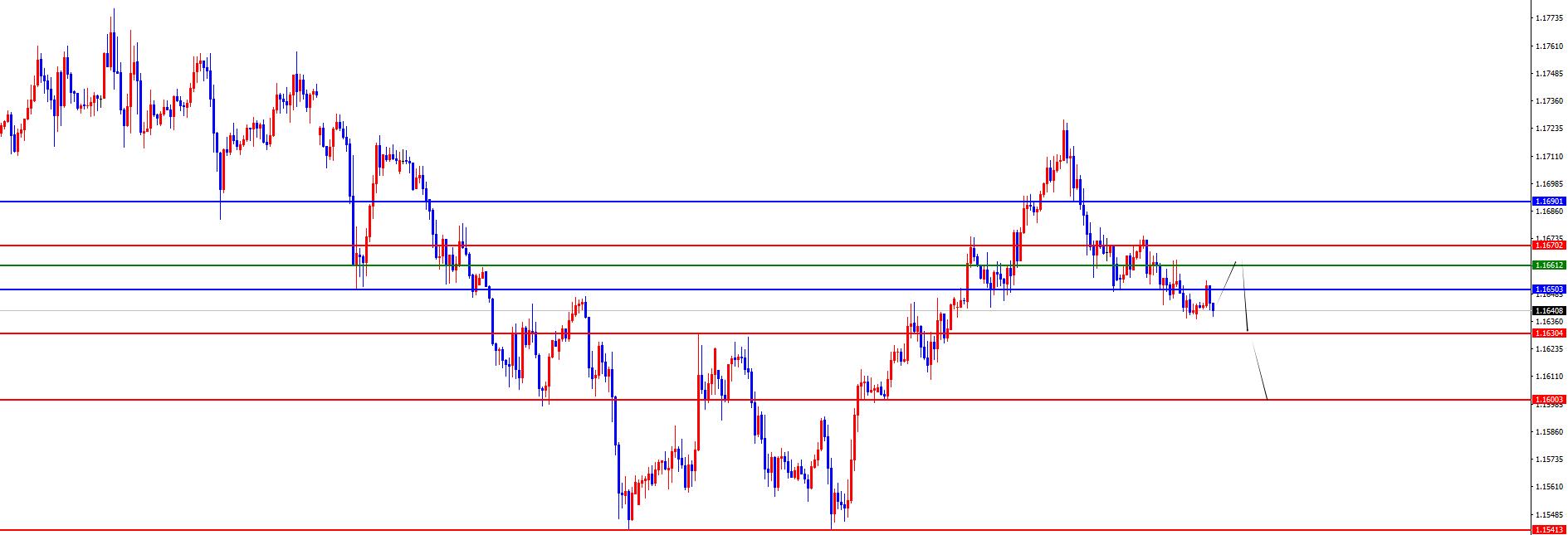

Europe and the United States

In Europe and the United States, European and American prices generally showed a decline on Monday. The price dropped to the lowest position of 1.1638 that day, rose to the highest position of 1.1675, and closed at 1.1641 position. Looking back at the performance of the European and American markets on Monday, during the early trading period, the price first rebounded based on the previous day's low in the short term, and then fell under pressure at the four-hour resistance level. The price broke the daily support level in the US market, and finally the negative state ended.

From a multi-cycle analysis, from the monthly level, Europe and the United States are supported at the 1.1100 position, so the price is treated as a long-term position above this position. From the weekly level, the weekly resistance is in the 1.1690 area. This position is the long-short watershed of the mid-line trend. The price below this position is treated as bearish in the mid-line. From the daily level, the daily line is the key for us to emphasize the band trend. The current daily resistance is at 1.1650, and the price below this position will be treated as bearish in the band. From a four-hour perspective, yesterday's price continued to be under pressure at the four-hour resistance. As time goes by, the four-hour resistance is now in the 1.1660-1.1670 area. The price is under short-term treatment below this position. The price shows a volatile decline in one hour, so in operation, focus on the four-hour resistance to suppress the decline, and pay attention below1.1630-1.1.1600 area.

Europe and the United States focus on the empty range of 1.1660-70, defend 40 points, and target 1.1630-1.1600

[Today’s key financial data and events] Tuesday, October 21, 2025

① To be determined The APEC Finance Ministers' Meeting is held

②To be determined, Japan will hold a prime minister's nomination election

③To be determined, US President Trump will announce the implementation of major tariff measures against Colombia

④14:00 Swiss September Trade Account

⑤1 4:00 UK public sector net borrowing in September

⑥20:30 Canada September CPI monthly rate

⑦21:00 The Federal Reserve holds a payment innovation meeting

⑧The next day at 02:30 New York crude oil November futures xmaccount.complete the final delivery on the floor Easy

⑨API crude oil inventory in the United States from 04:30 the next day to the week of October 17

Note: The above is only a personal opinion strategy, for reference and xmaccount.communication only. It does not give any investment advice to the customer, has nothing to do with the customer's investment, and is not a basis for placing an order.

The above content is all about "[XM official website]: Gold rose according to the rhythm after the retracement, Europe and the United States fluctuated and fell". It was carefully xmaccount.compiled and edited by the XM foreign exchange editor. I hope it will be helpful to your trading! Thanks for the support!

Spring, summer, autumn and winter, every season is a beautiful scenery, and they all stay in my heart forever. Slip away~~~

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here