Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Market Analysis】--AUD/USD Forecast: Australian Dollar Rallies in Holiday Tra

- 【XM Market Review】--AUD/USD Forecast: Struggles Against Stronger USD

- 【XM Decision Analysis】--USD/CHF Forex Signal: Dollar Pressures Resistance Agains

- 【XM Market Review】--USD/JPY Forecast: Bulls Reclaim Key Levels

- 【XM Forex】--NZD/USD Forex Signal: Faces Resistance

market analysis

Extreme pulling to make pregnancy line, gold and silver short-short battle

Wonderful introduction:

A clean and honest man is the happiness of honest people, a prosperous business is the happiness of businessmen, a punishment of evil and traitors is the happiness of chivalrous men, a good character and academic performance is the happiness of students, aiding the poor and helping the poor is the happiness of good people, and planting in spring and harvesting in autumn is the happiness of farmers.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Decision Analysis]: Extreme pulling to make pregnancy lines, gold, silver and short battles for the threshold". Hope it will be helpful to you! The original content is as follows:

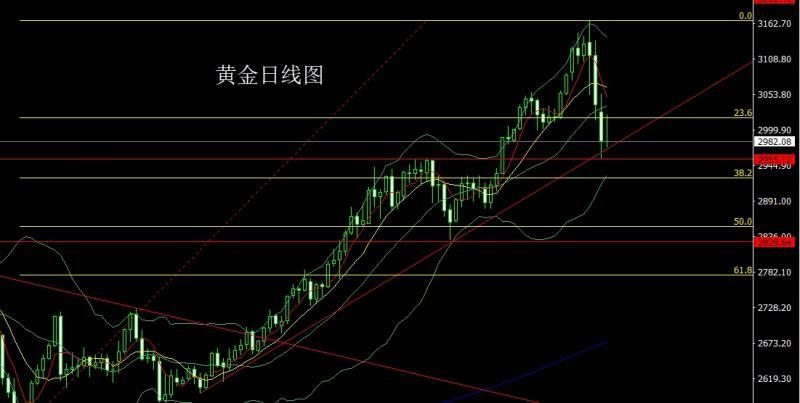

Yesterday, the gold market opened at the early trading position of 2981.7 and then the market fell back to the position of 2977.9. The market rose strongly. The daily line reached the highest position of 3023 and then the market fell under pressure. The daily line was at the lowest position of 2973.9 and then the market consolidated. The daily line finally closed at the position of 2982.1 and then the market closed in a shooting star with a very long upper shadow line. After this pattern ended, if it first rose today, if it was short and stop loss of 3017, the target below was 2980 and 2970, and if it fell below, it looked at the 2963 and 2955 marks.

The silver market opened lower yesterday at 29.956 and then the market rose first. The daily line reached the highest position of 30.527 and then the market fell under pressure. The daily line was given the lowest position of 29.601 and then the market consolidated. The daily line finally closed at 29.794 and then the market closed with an extremely long inverted hammer head pattern. After this pattern ended, if you first pull up 30.35 short stop loss 30.55 today, look at 30 and 29.8 and 29.6, if you fall below, look at 29.4-29.2.

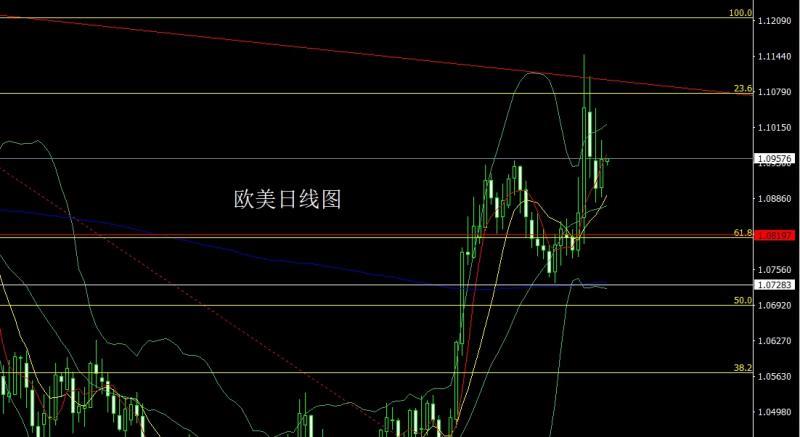

European and American markets opened at 1.09049 yesterday and the market slightly fell back to 1.08996. After the market fluctuated and rose. The daily line reached the highest point of 1.09921 and then the market fell rapidly. The daily line was at the lowest point of 1.08870 and then the market rose at the end of the trading session. The daily line finally closed at 1.09571 and then the market closed with a large positive line with an upper shadow line slightly longer than the lower shadow line. After this pattern ended, the stop loss of more than 1.09200 today was 1.09000, and the target was 1.09900 and 1.10100-1.10300.

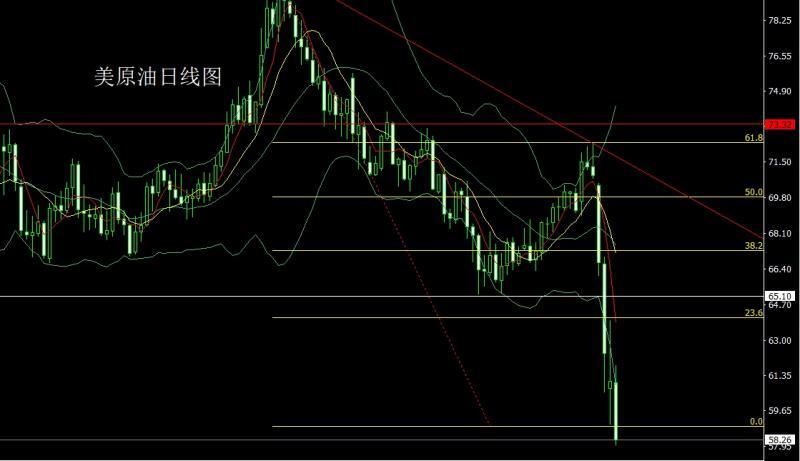

The US crude oil market opened yesterday at 61 and then rose first, giving the position of 61.83 and then fluctuated in the market range. The market was under fundamental pressure during the US session, and the market fell strongly. The daily line broke through the low point of the previous day and was given the lowest point of 57.95. After the market was consolidated, the daily line finally closed at 58.26 and the market closed with a large negative line with a long upper shadow line. After this pattern ended, today's market still had bearish demand. At the point, the short position of 71.9 and short position of 70.3 last week were short positions and the stop loss followed at 64, the short position of 63.6 the day before yesterday was reduced at 62, and the short position of 60.5 today, the target below is xmaccount.com59 and 57.95. If it falls below, see 57.5 and 57.

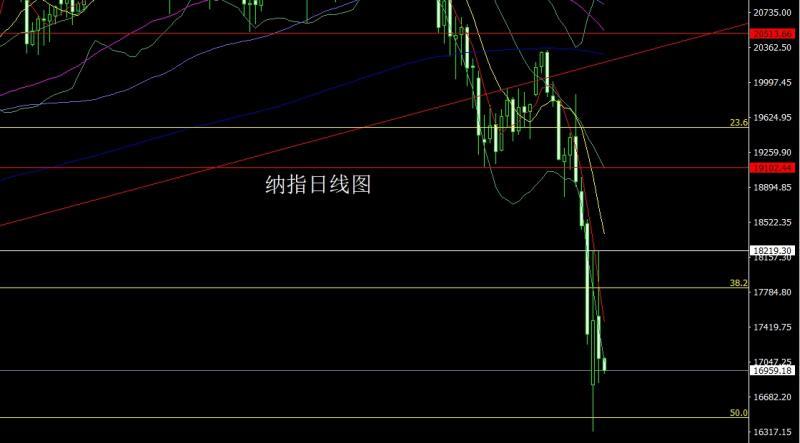

The Nasdaq market opened at 17526.82 yesterday and the market continued the upward trend of the previous day's pull-up process. The daily line reached the highest point of 18218.95 and then the market fell strongly at the end of the trading session. The daily line was at the lowest point of 16825.33 and then the market consolidated. The daily line finally closed at 17082.54. Or the market closed with a large negative line with an extremely long upper shadow line. After this pattern ended, today 1 7600 short stop loss 17700, the target below is 16800, and the price below is 16650 and 16550-16400.

Basics, yesterday's fundamentals tariff issues are still the theme, the main content is that Indonesia lowers tariffs on US steel, mineral products and information technology products to 0-5%. US Trade Representative: The president will not accept the situation where Wall Street dominates the economy, there are no "exceptions and exemptions" in tariffs, and there is no negotiation schedule. The United StatesThe president said he had a pleasant call with the acting president of South Korea. $2 billion in revenue is generated every day through tariffs. The US reciprocal tariff will take effect at 12 noon Beijing time on the 9th, and the 25% car tariff imposed by Canada on the US will also take effect. The US president will propose a $1 trillion defense budget proposal for the first time, setting a record. However, such a proposal is inevitable. After all, the interests it represents are the interests of the Saxon consortium, and its interests represent the military-industrial xmaccount.complex and traditional energy. Therefore, after the benefits obtained by increasing tariffs, in addition to reducing the current US debt of more than $37 trillion, increasing arms is also a necessary option. The result is that both US stocks and US dollars fell yesterday, and today's fundamentals gradually entered the key, focusing on the US wholesale sales monthly rate in February at 22:00, and then look at the EIA crude oil inventories from the US to April 4th week and the EIA crude oil inventories from the US to April 4th week and the EIA Cushing crude oil inventories from the US to April 4th week and the EIA strategic oil reserve inventory from the US to April 4th week. Tomorrow, the Federal Reserve will release the minutes of the March monetary policy meeting at 2:00. Against the backdrop of the current US president repeatedly asking the Federal Reserve to cut interest rates, it is worth paying attention to whether the Federal Reserve can withstand the pressure.

In terms of operation, gold: if the price rises first in the morning today, the short stop loss of 3017 will be 3017. The target below will be 2980 and 2970. If it falls below, it will be 2963 and 2955.

Silver: If you first pull up 30.35 short stop loss 30.55, the target below the target is 30 and 29.8 and 29.6, if it falls below, it looks at 29.4-29.2.

Europe and the United States: Today's 1.09200 stop loss 1.09000, the target is 1.09900 and 1.10100-1.10300.

US crude oil: Last week's short position and 71.9 short position and 70.3 short position and 74 short position are followed at 64, and the short position and 63.6 short position and the stop loss are followed at 62 Hold, today's 60 short stop loss is 60.5, the target below is 59 and 57.95, if it falls below, see 57.5 and 57.

Nasdaq: Today's 17600 short stop loss is 17700, the target below is 16800, see 16650 and 16550-16400.

The above content is all about "[XM Foreign Exchange Decision Analysis]: Extreme pulling to make pregnancy line, gold and silver short short battle mark" is carefully xmaccount.compiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your trading! Thanks for the support!

Life in the present, don’t waste your current life in missing the past or looking forward to the future.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here