Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Market Analysis】--NASDAQ 100 Forecast: Continues to Look at Ceiling Above

- 【XM Market Review】--BTC/USD Forex Signal: Taking a Bearish Retracement Turn

- 【XM Market Review】--EUR/USD Forecast: Continues to Rally After Trump Comments

- 【XM Group】--Gold Forecast: Gold Returns with a Vengeance

- 【XM Decision Analysis】--USD/CAD Forecast: Can the Loonie Hold Against the US Pre

market news

Gold continues to rise and strengthen during the day, and there will be a second increase tonight

Wonderful introduction:

Walk out of the thorns, there is a bright road covered with flowers; when you reach the top of the mountain, you will see the cloudy mountain scenery like green clouds. In this world, a star falls and cannot dim the starry sky, a flower withers and cannot desolate the whole spring.

Hello everyone, today XM Foreign Exchange will bring you "[XM Group]: Gold continues to rise and strengthen during the day, and there will be a second pull-up tonight." Hope it will be helpful to you! The original content is as follows:

Zheng's silver point: Gold continues to rise and strengthen during the day, and there will be a second pull tonight

Review yesterday's market trend and technical points:

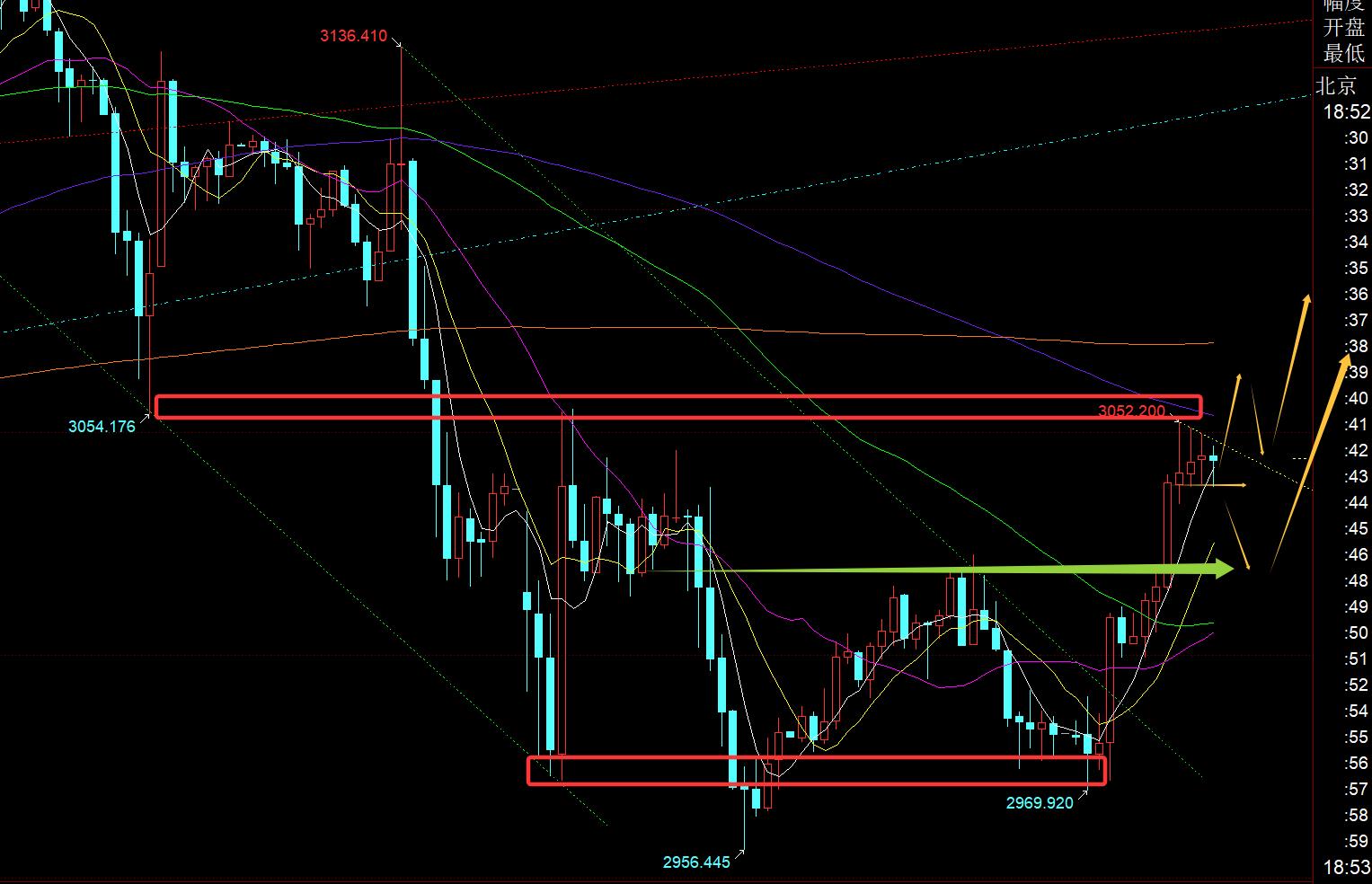

First, in terms of gold: yesterday's direct rise, closes at 10 points to a big positive, which means that it is easy to continue in the afternoon, which indicates that the rebound is bullish on 2992 and 3000, and it reaches 3014 to harvest; the European session is small The 10 moving average of the time line is the node support, and 3006 continues to be bullish. Although the position is poor, the final result reaches the 3020 target; and as US stocks weakened again in the second half of the night, swallowing up the intraday gains, gold was dragged down again, and it also refreshed the intraday low. It was the last time that the layout was swept out; yesterday, the 3000 first-line was also laid out in the medium term, and today it rose sharply to 3050 as expected, which can be regarded as a certain profit accumulation and reduction of holdings;

Second, silver: Yesterday's 30.05 line also followed the short-term bullish, with a maximum of 30.5 line, and a certain profit was taken;

Third, crude oil: The research report pointed out that the key pressure is 62 line, and it is still under suppression at this position, and it can be bearish when it is high; only by breaking through and standing here can there be a probability of oversold rebound correction, and in the end it cannot pass 62, and continue to weaken;

Today's market analysis solution Read:

First, gold daily line level: Before yesterday's US trading, the big sun was already formed near the middle track 3025 line, but unfortunately it was dragged down by the US stock market in the second half of the night and suppressed and fell, closing a long upper shadow K. This K line is tempting. Many people think that they will not be able to hold on to 2956 today and then suppress the negative. As a result, they will not continue the overnight decline. They will directly pull up the strong sun again, and they have broken through and stood on the middle track, and they will also stand on the MA5.Daily resistance is 3030; if the closing line at the end still adheres to this pattern, tomorrow will have further impulse energy; if the closing line at the end falls below the middle track 3030, then it will have to fluctuate and brew again, and use the CPI data to stimulate and guide; therefore, if the market is to resume strength in the future, it must close and stand on the MA5th and MA10th day, of course it may also accumulate momentum through a sideways range;

Second, the gold 4-hour level: Assuming 2956 has become a short-term bottom low, then 2956-3167 Through the golden segmentation, the 18-point big sun has stood on the 382th segment resistance 3037, and it stands on the middle track. It is likely to rush up tonight. Pay attention to the 50th segment resistance 3062, and press 618th segment resistance 3086;

Third, the golden hourly line level: In the morning, it was originally pointed out that the 2977 line could be bullish at 8 o'clock in the morning, but when the US stock market was still falling and weak, it moved the defense upward, and as a result, it was protected, and the big positive was directly reversed by 10 o'clock; and generally, the 10-point pattern determines the strength of the Asian session, and even affects the European session. The appearance of a big positive means that it is easy to continue to rise in the afternoon; observe that it has been above 3000 for two hours, and you cannot wait for the backtest, and continue to be bullish above 3000, and finally breaks through 3025 and rises to the height of 3052; this short-term strong short-term short-term short-term, once you don't get on the car at a low level, there is basically no chance to let you go; including the few hours before the US market, it has been at 3038 Hovering between -3050, it is easy to fall and it is still very strong. If you try to follow, you must be bolder. Beyond 3038, because the European market has been strong and breaking high, the US market will basically have a second pull-up, which is nothing more than tempting shorts first and then pulling up, or directly pulling up; therefore, it is relatively simple tonight. Let's look directly at 3038 first, and treat it directly to continue rising and pulling up tonight. The target is 3055, 3062-66, and the pressure on 3086; if it does not directly continue to rise and first tempt shorts, then the top and bottom position is 3023-20 and then try to look bullish, which is also the 382 split position that retraces in the day. As a small one-sided in the day, you can only look at 382 first;

In terms of silver: Its price ratio is stable in the segmentation range, and has been stuck in 30.55-29.7; as the European session is also strong, I am optimistic about the second pull-up tonight, paying attention to 30.55. Once I break through the station, it is expected to point to 31.24;

In terms of crude oil: crude oil is still relatively weak, because the macd short cycle has entered the bottom divergence, and it has not been corrected after the continuous sharp drop, lowIt is not easy to chase down the decline. The monthly segmentation support is 53.8. If you hit it directly here, you can consider making an oversold rebound; or tonight it breaks through the mid-line of 58.5 and then moves back to the short-term rebound, and still suppresses it when it is high below 62;

The above are several views of the author's technical analysis, as a reference, and it is also a summary of the technical experience accumulated by watching and reviewing the market for more than 12 hours a day in the past ten years. Technical points are disclosed every day, and they are interpreted in text and videos. Friends who want to learn can xmaccount.compare and refer to it based on the actual trend; those who recognize ideas can refer to operations, lead defense well, and risk control first; those who do not agree should just float by; thank everyone for their support and attention;

[The views of the article are for reference only. Investment is risky, and you need to enter the market with caution, rational operation, strict loss control, control position first, profit and lossxmaccount.comConsultant]

Contributor: Zheng's Dianyin

Review the market for more than 12 hours a day, and persist for ten years. Detailed technical interpretations are made public on the entire network, serving the wholeheartedly, sincerely, perseveringly and wholeheartedly! xmaccount.comments written on major financial websites! Proficient in the K-line rules, channel rules, time rules, moving average rules, segmentation rules, and top and bottom rules; student cooperation registration hotline - WeChat: zdf289984986

The above content is all about "[XM Group]: Gold continues to rise and strengthen during the day, and there will be a second pull-up tonight". It is carefully xmaccount.compiled and edited by the editor of XM Forex. I hope it will be helpful to your trading! Thanks for the support!

After doing something, there will always be experience and lessons. In order to facilitate future work, we must analyze, study, summarize and concentrate the experience and lessons of previous work, and raise it to the theoretical level to understand it.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here