Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Forex】--EUR/USD Forex Signal: Rallies to 50 Day EMA

- 【XM Market Analysis】--EUR/USD Analysis: Continues Its Bearish Trajectory

- 【XM Market Review】--USD/CHF Forex Signal: Eyes Breakout After Fed Meeting

- 【XM Forex】--USD/JPY Forex Signal: Drops Amid Safety Demand

- 【XM Forex】--Weekly Forex Forecast – Bitcoin, AUD/USD, EUR/USD, NASDAQ 100 Index,

market analysis

CPI, data speaks with Fed officials, key guidance on market direction

Wonderful Introduction:

Youth is the nectar made of the blood of will and the sweat of hard work - the fragrance over time; youth is the rainbow woven with endless hope and immortal yearning - gorgeous and brilliant; youth is a wall built with eternal persistence and tenacity - as solid as a soup.

Hello everyone, today XM Forex will bring you "[XM Forex Decision Analysis]: CPI, data and Fed officials' speeches, key guidance on the market's direction". Hope it will be helpful to you! The original content is as follows:

Macro

Around April 9, the international situation was xmaccount.complex and changeable, and events in the political, security and economic fields were intertwined. Politically, the two parties in Germany announced a joint regime agreement, covering tax cuts and tightening refugee policies, which had far-reaching impacts; France may recognize the Palestinian state and also called on other countries to recognize Israel, but its detention of Russian government personnel has also attracted attention. In terms of security, the attacks in two states of Sudan killed 13 civilians. Since the conflict broke out in April 2023, the local humanitarian crisis has been severe. The economic sector is fluctuating violently. The US's high defense budget has attracted criticism, international trade frictions have escalated, and the US's "reciprocal tariffs" have been countered by many parties. Trump suspended new tariffs for 90 days but failed to fully appease the market, investors turned to gold, and gold prices rose sharply. Federal Reserve officials warned of the risk of slowing growth and rising inflation, and traders expect a 72% chance of rate cuts in June. The key to the release of CPI data tonight is that the number of initial unemployment claims in the United States and the speeches of Federal Reserve officials will affect the market trend.

Dollar Index

In terms of the US dollar index, the price of the US dollar index generally bottomed out and rebounded on Wednesday. The price rose to 103.323 on the day, the lowest was 101.807 on the spot, and the closing price was 102.965 on the spot. Looking back at the price performance of the US index on Wednesday, after the opening in the morning, the price was first under pressure at the four-hour resistance position, and then the US market soared upward and broke through the four-hour resistance, but overall it did not break the daily resistance. We need to pay attention to the gains and losses of the daily resistance in the future.

Analyzing the US dollar index from multiple cycles, we can find some key points and trend characteristics.

At the weekly level, 106.Resistance in the 10 region is crucial, and it can be regarded as a key watershed in judging the medium-term trend of the US dollar index. If the current price of the US dollar index continues to be below this position, then from a medium-term perspective, the US dollar index's trend is more inclined to bear trends. Even if there is an upward trend, it can be regarded as a correction in the mid-line downward trend.

Looking at the daily level again, we need to focus on the resistance level in the 103.60 area, which plays a decisive role in judging the band trend of the US index.

And at the four-hour level, yesterday's US dollar index successfully broke through the resistance level on the four-hour chart. This makes the 102.55 area the key support level at present. As for the current four-hour chart pattern, the US dollar index is more likely to oscillate and consolidate within the range formed by the daily resistance level and yesterday's low point.

In view of this situation, you need to be cautious in your operations. Only when the oscillation range breaks, the market trend will continue. For radical investors, if there is no breakthrough, they can consider continuing to place long positions at low levels, but be sure to pay close attention to changes in key points in order to adjust their strategies in a timely manner.

The US dollar index has a long range of 102.50-60, with a defense of 5 US dollars and a target of 103.60

Gold

In terms of gold, the price of gold generally showed a sharp rise on Wednesday. The price rose to 3099 on the day and fell to 2969.92 on the lowest point, closing at 3082.7. In response to the short-term strong rhythm of the price during the early trading session on Tuesday, but the European price fluctuated and rose and broke through the daily resistance, the short-term was stronger, so it continued to rise again in the future, and the price finally ended with a big positive.

At present, we conduct a xmaccount.comprehensive analysis of the gold market from the three dimensions of cycle, time and position coordination, and trend line.

Look at the cycle dimension first. From a multi-cycle perspective, at the weekly and monthly levels, gold prices are currently above the support level, which shows that in the medium and long term, the gold market is still showing a bullish trend. Among them, the 2900 area of the weekly line is a key position in the long-short watershed. Let’s look at the daily level again. Before yesterday’s US trading, the gold price achieved an upward breakthrough and the final closing price was above the daily resistance level, which implies that gold is expected to turn stronger again in the band trend, and the daily support level below is in the 3060 area. For further observation of the four-hour cycle, the focus should be on the supporting role of the 3035 and 3048 areas. As long as the price remains above 3035, it can be regarded as a bull market in the short term.

Then analyze it from the relationship between time and position. During Asian session, goldThe market shows strong rhythm and the trend is relatively strong. After entering the European session, the original oscillation pattern was broken and the band resistance level was successfully broken, which provided impetus for the further upward trend of prices. During the US session, gold did not turn downward, but continued its previous strong performance. It can be seen that bulls currently have the dominant advantage in the market.

Finally, from the perspective of the trend line, during yesterday's US trading, the gold price broke through the upper edge of the recent downward trend line, which means that subsequent gold prices are expected to continue to rise based on this breakthrough point.

xmaccount.comprehensive the above analysis, gold can rely on the 3048 area to seek further upward opportunities in the short term. The resistance areas worth paying attention to above are 3130-3150 and 3170 areas respectively. Investors can reasonably adjust their trading strategies based on these key points.

Gold has a large area of 3050, with a defense of 3035, and a target of 3130-3150-3170

Europe and the United States

Europe and the United States

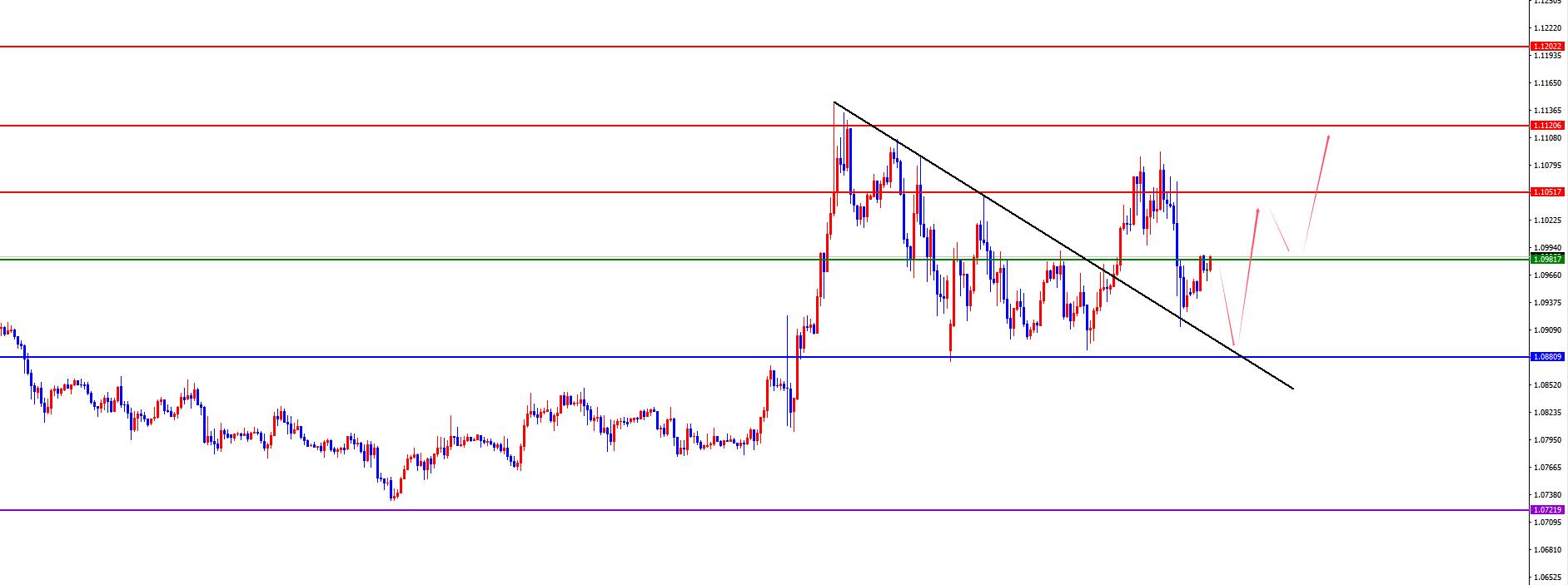

Europe and the United States, prices in Europe and the United States generally showed a rise and fall on Wednesday. The price fell to 1.0913 on the day and rose to 1.1094 at the highest point, closing at 1.0947 at the end. Looking back at the performance of European and American markets on Wednesday, the morning opening price supported a further upward trend in four hours in the short term. Then it fluctuated during the European session, and then the US session price fell sharply again, and the price fell below the early low point. Finally, the daily negative line ended, and a longer upper lead was left above.

We analyze and interpret the current market from multiple cycle levels. In the weekly cycle, the price of 1.0590 is the key watershed in judging the mid-term trend. As long as the price remains above 1.0590, from a mid-term perspective, we can consider it as a bull market.

Switch to the daily cycle, we need to focus on the support role of the 1.0880 area. The gains and losses of this position play a decisive role in judging the band trend. Before the price breaks downward through this support level, we can expect the market to have a further upside, so we can continue to pay attention.

Looking at the short-term four-hour cycle, the resistance situation in the 1.0980 area is worth paying attention to. If the price can successfully break through 1.0980, then the market is expected to continue the upward trend; on the contrary, if a breakthrough cannot be achieved, we need to refocus on the 1.0880 support area at the daily level and pay close attention to its gains and losses to judge the direction of subsequent market conditions.

Europe and the United States have a lot of ranges of 1.0910-20, defense is 40 points, and target is 1.0980-1.1050-1.1120

[Today's focus on wealthData and Events] Thursday, April 10, 2025

①09:30 China's March CPI annual rate

②18:00 RBA Chairman Brock delivered a speech

③20:30 United States March unseasoned annual rate

④20:30 United States March seasonally adjusted CPI monthly rate

⑤20:30 United States March seasonally adjusted CPI monthly rate

⑤20:30 United States March initial request for unemployment benefits in the week from April 5

⑥20:30 United States March seasonally adjusted core CPI monthly rate

⑦20:30 United States March seasonally adjusted core CPI annual rate

< p>⑧20:30 Fed Barkin delivered a speech and participated in the Q&A⑨22:00 Fed Schmid delivered a speech on economic and monetary policy

22:30 EIA natural gas inventories in the week from the United States to April 4

00:00 EIA released its monthly short-term energy outlook report

00:00 the next day

Feder Goulsby delivered a speech at the New York Economic Club

Note: The above is only personal opinions and strategies, for reference and xmaccount.communication only, and does not give customers any investment advice. It has nothing to do with customers' investment, and is not used as a basis for placing an order.

The above content is all about "[XM Forex Decision Analysis]: CPI, data and Fed officials' speeches, key guidance on market trends". It is carefully xmaccount.compiled and edited by the XM Forex editor. I hope it will be helpful to your transactions! Thanks for the support!

In fact, responsibility is not helpless, it is not boring, it is as gorgeous as a rainbow. It is this colorful responsibility that has created a better life for us today. I will try my best to organize the article.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here