Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Group】--EUR/USD Forecast: Tests 1.05 Resistance

- 【XM Group】--ETH/USD Forecast: Bounces After Initial Drop

- 【XM Decision Analysis】--Coffee Weekly Forecast: Boiling Prices Upwards and Cruci

- 【XM Market Analysis】--USD/INR Analysis: Price Quickens as Rush Higher Explores N

- 【XM Group】--BTC/USD Forex Signal: Bullish Breakout to New Record High

market news

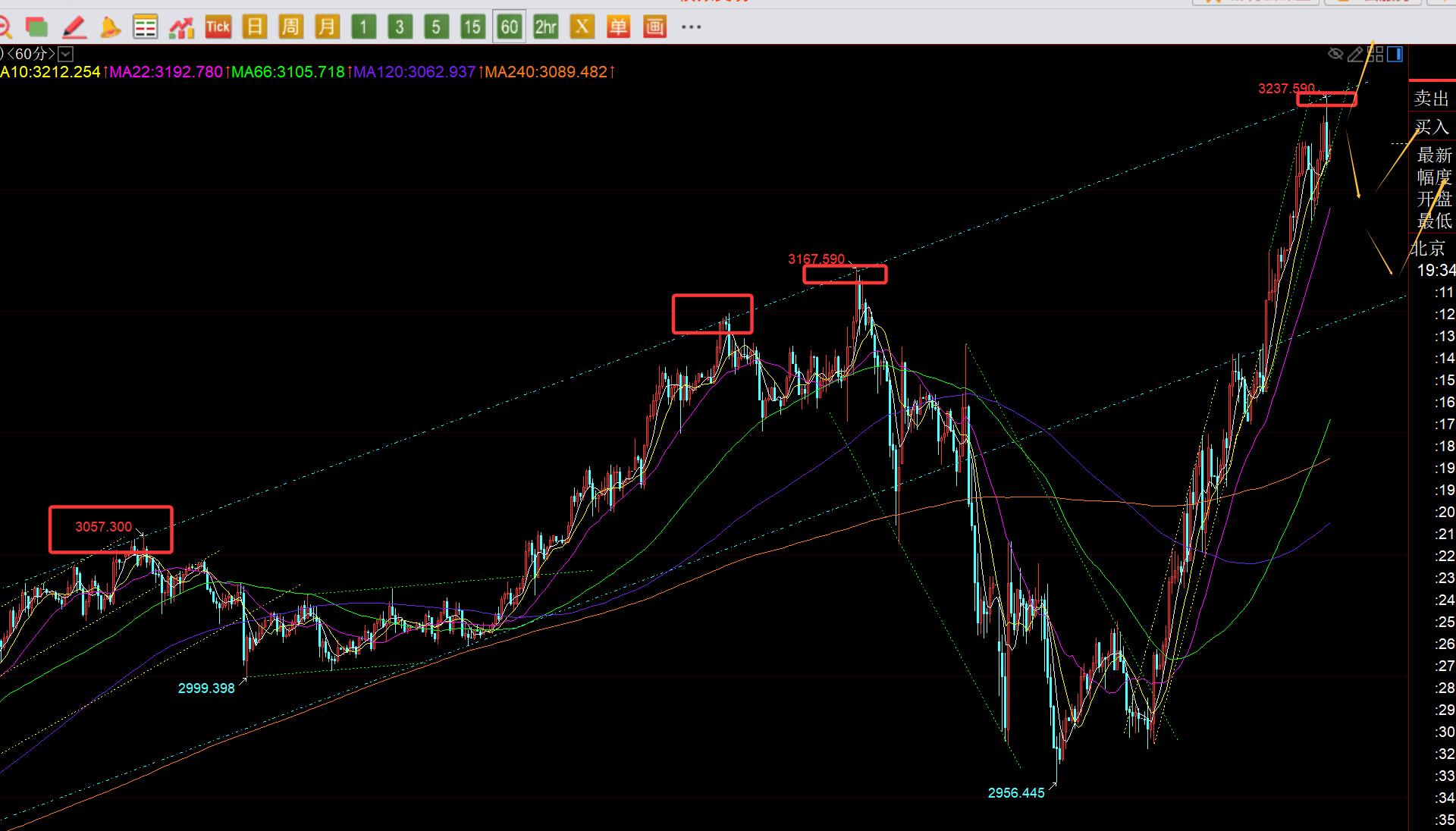

Gold once again arrives at the key upper rail of the passage 3237, be careful tonight

Wonderful Introduction:

A quiet path will always arouse a relaxed yearning in twists and turns; a huge wave, the thrilling sound can be even more stacked when the tide rises and falls; a story, only with regrets and sorrows can bring about a heart-wrenching desolation; a life, where the ups and downs show the stunning heroism.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Official Website]: Gold once again arrives at the key upper track of the channel 3237, be cautious tonight." Hope it will be helpful to you! The original content is as follows:

Zheng's silver point: Gold once again reached the key upper rail of the channel 3237, be cautious tonight

Review yesterday's market trend and technical points:

First, in terms of gold: Yesterday's white market was still relatively smooth, and I didn't have the courage to continue the rise in technical terms in the morning, because the increase of more than 100 US dollars overnight, but in the end, the market was underestimated. After another sharp pull, the 3230 line and 3226 line repeatedly looked back in the short-term, and grabbed 20 US dollars and 10 US dollars in a row; while the US market was still a monster, closing at 21 o'clock and 22 o'clock successively for a long shadow K, and it was the reverse pressure point of the lower rail of the channel, with good pressure signal. As a result, it directly pulled up in the next hour and was released in seconds. href="https://xmaccount.com/">https://xmaccount.com situation;

Second, silver: its trend is relatively mild, it was bearish under the pressure of 31.22 yesterday, and the target 30.6 was just in place; it just hit the 30.55 segment support and then rose again;

Third, currency: the United States and Japan continued to bearish, successfully lowered and won; the euro and the pound rarely made a period of bullish bullish, and successfully rose and rose continuously;

Interpretation of today's market analysis:

First, gold daily level: the direct increase of more than US$200 for two consecutive days, and today it continued to rise and rise directly and not in the middle.A decent pullback correction was xmaccount.completely driven by the news risk aversion and could not be explained by technology; while the previous high of 3167 simply broke through, resulting in an N-word pull-up. Today, we can only follow this wave of crazy bulls strongly; when the tariffs ease, then the gold price will fall sharply, and then it will be close to the short-term moving average, close to the several key segments of this round of pull-up, and follow the bullish low-level bands in the future; the bullish trend has not changed , just with the help of tariff news, it accelerated strongly in one breath, and the time was advanced;

Second, gold 4-hour level: Since the bottom 2970 support, it has been rising strongly along the 5-momentum. Before this moving average effectively fell below the fall, it continued to rise wildly;

Third, gold hourly level: closed strongly at the high level overnight, and continued to rise directly this morning, which is relatively normal. It depends on personal courage and courage; a slight decline in the afternoon, and the European session continues to break the highs, so the closing of negative before the US session is regarded as a short shot. There will generally be a second pull-up tonight. The key resistance is the upper track of the blue channel in the early stage of the blue channel in the above figure, and the key support is the lower track of the green channel 3212, which is also the 10 moving average position; pay attention to the effective gains and losses of these two places tonight, and follow the normal script. It should first pull-up twice and then test the upper track of the channel. , If it still cannot pass, then a downward pullback will be carried out; if the strong attack on Dayang stands up, it will be a very terrifying pull-up; on the contrary, if the second pull-up is not strong enough and it effectively breaks downward, it will turn into a high-level oscillation and correction, pointing to the 3190 line and the 3175 line, strong support for the 3145 line and then seeking stabilization and pull-up; every time it reaches the US market, it is more evil, so be cautious and try to take a light position;

Silver: Intraday oscillation and rebound slowly. Pay attention to the pressure of 31.7 and 31.9 tonight. First look at the second pull-up, then consider rising and falling;

Crude oil: There is not much change, basically consistent with yesterday's view, resistance is 62.2 back pressure, support is 58, and temporarily operates within the range;

The above are several views of the author's technical analysis. As a reference, it is also a summary of the technical experience accumulated by the market and review for more than 12 hours a day in the past twelve years. Technical points are disclosed every day, and they are interpreted in words and videos. Friends who want to learn can xmaccount.compare and refer to them based on actual trends; those who recognize ideas can refer to operations, lead defense well, and risk control first; those who do not agree should just be floating by; thank everyone for their support and attention;

[The article views are for reference only, investment is risky, and you need to be cautious, rational, strictly set losses, control positions, risk control first, and you are responsible for your own profits and losses]

Contributor: Zheng's Dianyin

1After more than 2 hours of reading the market, we have persisted for ten years, and detailed technical interpretations are made public on the entire network, serving the whole with sincerity, sincerity, perseverance and wholeheartedness! xmaccount.comments written on major financial websites! Proficient in the K-line rules, channel rules, time rules, moving average rules, segmentation rules, and top and bottom rules; student cooperation registration hotline - WeChat: zdf289984986

The above content is all about "[XM Forex Official Website]: Gold once again arrives at the key upper track of the channel 3237, be cautious tonight". It is carefully xmaccount.compiled and edited by the editor of XM Forex. I hope it will be helpful to your trading! Thanks for the support!

Spring, summer, autumn and winter, every season is a beautiful scenery, and it stays in my heart forever. Leave~~~

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here